Increased Healthcare Expenditure

The rise in healthcare expenditure in the UK is a significant driver for the total hip-knee-replacements market. With the government and private sectors investing more in healthcare services, there is a greater focus on elective surgeries, including joint replacements. The NHS has allocated substantial funds to improve surgical facilities and patient care, which has led to an increase in the number of procedures performed. In 2025, healthcare spending is projected to reach £200 billion, with a notable portion directed towards orthopedic surgeries. This financial commitment indicates a growing recognition of the importance of joint health, thereby propelling the total hip-knee-replacements market forward.

Growing Awareness of Joint Health

There is a notable increase in public awareness regarding joint health and the benefits of timely surgical interventions. Campaigns promoting the importance of maintaining mobility and quality of life have led to more individuals seeking medical advice for joint pain. This heightened awareness is driving patients to consider total hip-knee replacements as viable options for alleviating chronic pain and restoring function. Surveys indicate that 60% of individuals experiencing joint pain are now more likely to consult healthcare professionals about surgical options. Consequently, this trend is expected to bolster the total hip-knee-replacements market as more patients opt for surgical solutions to improve their quality of life.

Rising Incidence of Osteoarthritis

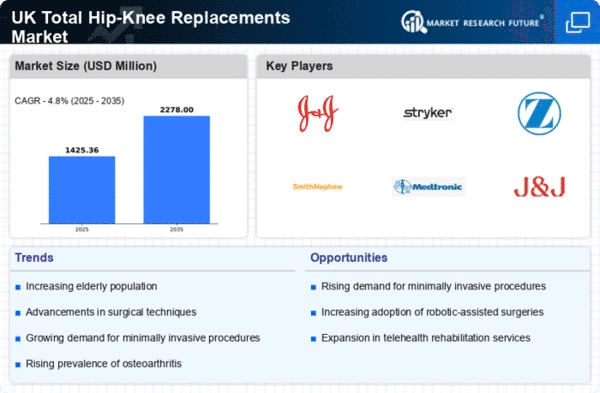

The increasing prevalence of osteoarthritis in the UK is a primary driver for the total hip-knee-replacements market. As the population ages, the incidence of osteoarthritis, a degenerative joint disease, rises significantly. According to recent data, approximately 8.5 million people in the UK are affected by osteoarthritis, leading to a growing demand for surgical interventions. This condition often necessitates total hip or knee replacements, as conservative treatments may become ineffective over time. The National Health Service (NHS) has reported a steady increase in joint replacement surgeries, with over 100,000 hip and knee replacements performed annually. This trend indicates a robust market potential, as healthcare providers seek to address the needs of an aging population suffering from joint-related ailments.

Advancements in Surgical Techniques

Innovations in surgical techniques are transforming the landscape of the total hip-knee-replacements market. Minimally invasive procedures, such as arthroscopy, are gaining traction, allowing for quicker recovery times and reduced hospital stays. These advancements not only enhance patient outcomes but also increase the number of surgeries performed. The introduction of robotic-assisted surgeries has further improved precision and efficiency, appealing to both surgeons and patients. Data suggests that hospitals adopting these advanced techniques experience a 20% increase in patient throughput for joint replacement surgeries. As surgical methods continue to evolve, the total hip-knee-replacements market is likely to expand, driven by the demand for safer and more effective treatment options.

Technological Integration in Patient Management

The integration of technology in patient management systems is emerging as a crucial driver for the total hip-knee-replacements market. Digital health solutions, including telemedicine and electronic health records, facilitate better pre-operative assessments and post-operative care. These technologies enhance communication between patients and healthcare providers, leading to improved patient satisfaction and outcomes. Data indicates that hospitals utilizing integrated health systems report a 15% reduction in post-surgical complications. As healthcare providers increasingly adopt these technologies, the total hip-knee-replacements market is likely to benefit from enhanced patient management and streamlined surgical processes.