Emergence of Remote Work and Virtual Selling

The Sales Intelligence Market is adapting to the emergence of remote work and virtual selling practices. As organizations increasingly embrace flexible work arrangements, the demand for sales intelligence solutions that support remote sales teams is on the rise. These tools facilitate collaboration and communication among team members, regardless of their physical location. The shift towards virtual selling has prompted companies to invest in technologies that enable effective remote engagement with customers. Recent trends indicate that the market for remote sales solutions is expected to grow substantially, with projections suggesting a potential increase of 15% annually. This evolution underscores the necessity for sales intelligence tools that can cater to the unique challenges posed by remote selling environments.

Growing Demand for Data-Driven Decision Making

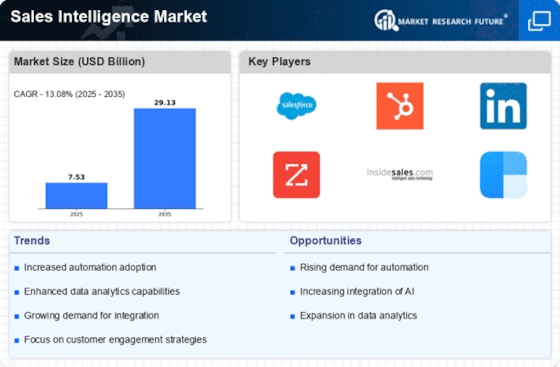

The Sales Intelligence Market is experiencing a notable surge in demand for data-driven decision making. Organizations increasingly recognize the value of leveraging data analytics to enhance sales strategies and improve customer engagement. According to recent estimates, the market for sales intelligence solutions is projected to reach approximately 3 billion USD by 2026, reflecting a compound annual growth rate of around 12%. This growth is driven by the need for businesses to make informed decisions based on real-time data insights. As companies strive to remain competitive, the adoption of sales intelligence tools that provide actionable insights is becoming essential. This trend indicates a shift towards a more analytical approach in sales processes, where data is not merely supplementary but central to strategic planning and execution.

Increased Focus on Sales Performance Optimization

The Sales Intelligence Market is witnessing an increased focus on sales performance optimization. Organizations are actively seeking solutions that can enhance the effectiveness of their sales teams and improve overall performance metrics. This trend is driven by the need to maximize return on investment in sales activities. Sales intelligence tools provide critical insights into sales processes, enabling teams to identify areas for improvement and implement data-driven strategies. Market analysis suggests that the sales performance management sector is projected to grow significantly, with estimates indicating a potential market size of 2.5 billion USD by 2026. This growth reflects a broader recognition of the importance of optimizing sales performance through intelligent data utilization.

Advancements in Artificial Intelligence Technologies

The Sales Intelligence Market is significantly influenced by advancements in artificial intelligence technologies. AI-driven tools are transforming how sales teams operate, enabling them to analyze vast amounts of data quickly and accurately. These technologies facilitate predictive analytics, which helps organizations forecast sales trends and customer behavior more effectively. The integration of AI in sales intelligence solutions is expected to enhance efficiency and productivity, as it automates routine tasks and provides deeper insights into customer preferences. As a result, the market is likely to witness a substantial increase in the adoption of AI-powered sales intelligence tools, with projections indicating a potential market size of over 4 billion USD by 2027. This evolution suggests that organizations are increasingly prioritizing innovative technologies to gain a competitive edge.

Rising Importance of Customer Relationship Management

The Sales Intelligence Market is increasingly intertwined with the rising importance of customer relationship management (CRM) systems. As businesses strive to enhance customer experiences, the integration of sales intelligence with CRM platforms is becoming a strategic necessity. This integration allows for a seamless flow of information, enabling sales teams to access valuable insights about customer interactions and preferences. Recent data indicates that the CRM market is expected to grow to approximately 80 billion USD by 2025, which in turn fuels the demand for sales intelligence solutions that can complement these systems. The synergy between CRM and sales intelligence tools is likely to empower organizations to build stronger relationships with customers, ultimately driving sales growth and improving retention rates.