The Sales Performance Management Market is currently experiencing a dynamic evolution, driven by the increasing need for organizations to optimize their sales processes and enhance overall productivity. Companies are increasingly recognizing the value of data-driven insights, which facilitate informed decision-making and strategic planning. As a result, there is a growing emphasis on integrating advanced technologies such as artificial intelligence and machine learning into sales performance management solutions. This integration appears to enhance forecasting accuracy and streamline sales operations, thereby contributing to improved revenue generation.

Moreover, the market is witnessing a shift towards more personalized and adaptive sales strategies. Organizations are focusing on tailoring their approaches to meet the unique needs of their customers, which may lead to higher engagement and satisfaction levels. This trend suggests that companies are not only investing in technology but also in understanding customer behavior and preferences. As the Sales Performance Management Market continues to evolve, it is likely that these trends will shape the future landscape, fostering a more agile and responsive sales environment.

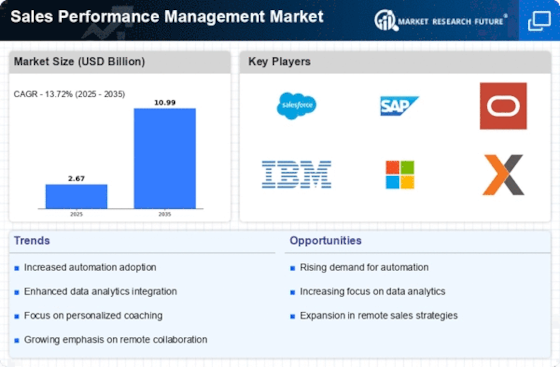

The sales performance management industry is witnessing steady growth as organizations increasingly adopt advanced sales performance management solutions to improve forecasting accuracy, incentive compensation, and overall sales productivity. The report provides a detailed assessment of industry size growth rate and sales projections, highlighting strong expansion driven by digital transformation and data-driven sales strategies. The adoption of SPM sales performance management platforms is accelerating as organizations leverage AI-enabled sales performance management solutions to enhance analytics, forecasting, and real-time decision-making. Artificial intelligence and machine learning are redefining the sales performance management industry by enabling predictive insights, automation, and improved sales planning capabilities.

Software-based sales performance management solutions continue to dominate the market due to their ability to automate sales operations, incentive management, and performance analytics. Cloud-based SPM sales performance management platforms offer scalability, flexibility, and seamless integration with CRM systems, driving widespread adoption across enterprises. Organizations are increasingly focusing on performance management sales strategies to align compensation planning, sales targets, and workforce productivity. Looking ahead, the sales performance management industry is expected to benefit from continued innovation in analytics, automation, and AI-driven sales optimization tools.

Integration of Advanced Technologies

The Sales Performance Management Market is increasingly incorporating advanced technologies such as artificial intelligence and machine learning. This integration is believed to enhance data analysis capabilities, allowing organizations to make more informed decisions and improve sales forecasting accuracy.

Focus on Personalization

There is a noticeable trend towards personalized sales strategies within the Sales Performance Management Market. Companies are prioritizing the customization of their sales approaches to align with individual customer preferences, which may lead to enhanced customer engagement and loyalty.

Emphasis on Data-Driven Insights

The importance of data-driven insights is becoming more pronounced in the Sales Performance Management Market. Organizations are leveraging analytics to gain deeper understanding of sales performance, enabling them to identify areas for improvement and optimize their sales processes.