Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is a significant driver for the Point of Care Diagnostics Testing Market. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders necessitate regular monitoring and timely interventions. As the global population ages, the demand for rapid diagnostic solutions that can be administered at home or in outpatient settings is likely to rise. Market data suggests that the incidence of diabetes alone is expected to reach 700 million cases by 2045, underscoring the urgent need for effective point of care testing solutions. This trend not only emphasizes the importance of early detection but also highlights the potential for point of care diagnostics to improve patient outcomes through timely treatment. Consequently, healthcare providers are increasingly adopting these technologies to enhance patient management and reduce healthcare costs.

Shift Towards Decentralized Healthcare

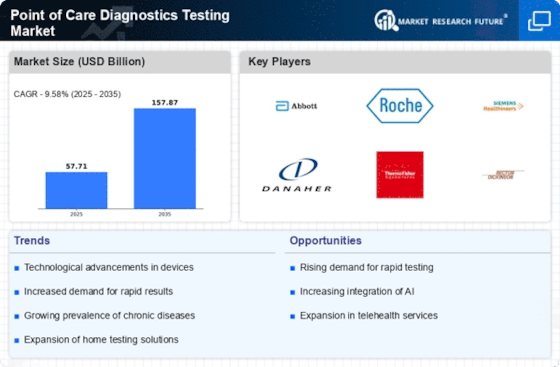

The Point of Care Diagnostics Testing Market is witnessing a notable shift towards decentralized healthcare models. This transformation is driven by the need for accessible and efficient healthcare services, particularly in remote or underserved areas. Decentralized testing allows for immediate results, reducing the need for patients to travel to centralized laboratories. Recent statistics indicate that the market for decentralized diagnostics is expected to grow at a compound annual growth rate of 10% over the next five years. This growth is fueled by the increasing adoption of telemedicine and home healthcare services, which are becoming integral to modern healthcare delivery. As a result, point of care diagnostics are positioned to play a crucial role in facilitating timely medical interventions and improving overall healthcare accessibility.

Increased Focus on Preventive Healthcare

The Point of Care Diagnostics Testing Market is significantly influenced by the growing emphasis on preventive healthcare. As healthcare systems worldwide shift from reactive to proactive approaches, the demand for early detection and monitoring tools is escalating. Preventive diagnostics enable healthcare providers to identify potential health issues before they escalate, thereby reducing the burden on healthcare systems. Market analysis indicates that the preventive healthcare market is projected to reach USD 200 billion by 2027, with point of care testing being a vital component. This trend is further supported by public health initiatives aimed at promoting regular health screenings and awareness campaigns. Consequently, the integration of point of care diagnostics into routine healthcare practices is likely to enhance patient engagement and foster a culture of preventive care.

Regulatory Support and Reimbursement Policies

The Point of Care Diagnostics Testing Market is benefiting from favorable regulatory support and evolving reimbursement policies. Governments and health authorities are increasingly recognizing the value of point of care testing in improving healthcare outcomes and reducing costs. Recent policy changes have streamlined the approval processes for new diagnostic devices, facilitating quicker market entry. Additionally, reimbursement frameworks are adapting to include point of care tests, making them more financially viable for healthcare providers. This regulatory environment is expected to encourage innovation and investment in point of care diagnostics, as evidenced by the projected growth of the market, which is anticipated to reach USD 60 billion by 2028. Such supportive measures are likely to enhance the adoption of point of care testing across various healthcare settings, ultimately benefiting patients and providers alike.

Technological Innovations in Point of Care Diagnostics

The Point of Care Diagnostics Testing Market is experiencing a surge in technological innovations that enhance testing accuracy and speed. Advancements in microfluidics, biosensors, and portable devices are transforming traditional diagnostic methods. For instance, the integration of artificial intelligence in diagnostic tools is streamlining data analysis, leading to quicker decision-making. According to recent data, the market for point of care testing devices is projected to reach USD 50 billion by 2026, driven by these technological advancements. Furthermore, the development of multiplex testing capabilities allows for simultaneous detection of multiple pathogens, which is particularly beneficial in managing infectious diseases. This trend indicates a shift towards more efficient and user-friendly diagnostic solutions, making them increasingly accessible in various healthcare settings.