Shift Towards Personalized Medicine

The movement towards personalized medicine is reshaping the landscape of the point of-care-molecular-diagnostics market. As healthcare providers increasingly recognize the importance of tailoring treatments to individual patient profiles, molecular diagnostics play a crucial role in identifying specific biomarkers. This shift is supported by the growing body of evidence suggesting that personalized approaches can enhance treatment efficacy and reduce adverse effects. The market is projected to expand as more healthcare facilities adopt molecular diagnostic tools to facilitate personalized treatment plans. Furthermore, the potential for improved patient outcomes may lead to a reduction in overall healthcare costs, making this an attractive proposition for stakeholders in the point of-care-molecular-diagnostics market.

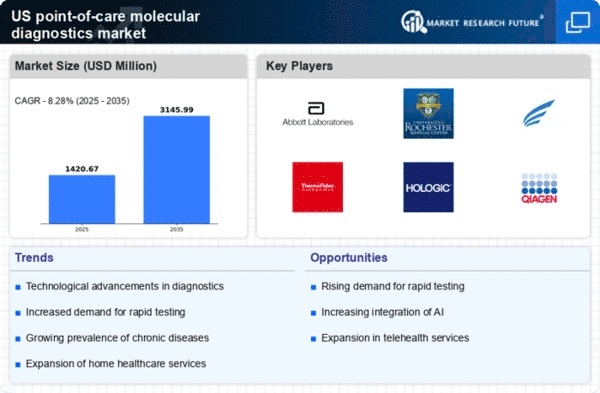

Expansion of Home Healthcare Services

The expansion of home healthcare services is emerging as a key driver for the point of-care-molecular-diagnostics market. With an increasing number of patients preferring to receive care in the comfort of their homes, there is a growing need for portable and user-friendly diagnostic tools. The home healthcare market in the US is projected to reach $173 billion by 2026, indicating a robust demand for point-of-care solutions. This trend suggests that the point of-care-molecular-diagnostics market will likely see increased adoption as healthcare providers develop strategies to deliver effective diagnostics outside traditional clinical settings, thereby enhancing patient convenience and accessibility.

Growing Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare is influencing the point of-care-molecular-diagnostics market. As healthcare systems shift from reactive to proactive approaches, there is a heightened demand for diagnostic tools that can identify health issues before they escalate. This trend is reflected in the rising investments in preventive care initiatives, with the US government allocating over $1 billion annually to support preventive health programs. The point of-care-molecular-diagnostics market stands to gain from this focus, as rapid and accurate diagnostics enable early detection and intervention, ultimately leading to better health outcomes and reduced healthcare costs.

Technological Integration in Healthcare

The integration of advanced technologies into healthcare systems is a significant driver for the point of-care-molecular-diagnostics market. Innovations such as artificial intelligence (AI) and machine learning are enhancing the capabilities of diagnostic tools, enabling faster and more accurate results. The US healthcare sector is increasingly investing in these technologies, with expenditures on health IT projected to reach $280 billion by 2025. This technological evolution not only improves diagnostic accuracy but also streamlines workflows in clinical settings. As healthcare providers seek to optimize their operations and enhance patient care, the point of-care-molecular-diagnostics market is likely to experience substantial growth driven by these technological advancements.

Rising Prevalence of Infectious Diseases

The increasing incidence of infectious diseases in the US is a primary driver for the point of-care-molecular-diagnostics market. As healthcare providers seek rapid and accurate diagnostic solutions, the demand for molecular diagnostics is expected to rise. According to the Centers for Disease Control and Prevention (CDC), infectious diseases account for a significant portion of healthcare expenditures, with costs exceeding $120 billion annually. This trend indicates a growing need for effective diagnostic tools that can provide timely results, thereby facilitating prompt treatment decisions. The point of-care-molecular-diagnostics market is likely to benefit from this rising prevalence, as healthcare systems prioritize the implementation of advanced diagnostic technologies to improve patient outcomes.