Market Trends

Key Emerging Trends in the Point of Care Diagnostics Testing Market

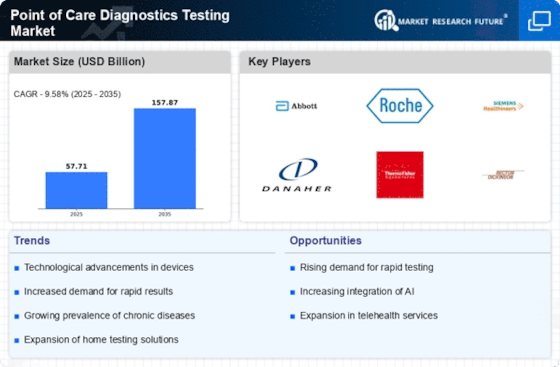

Changes have occurred in Point of Care Diagnostics/Testing (POCT) due to technological advancements that have necessitated rapid and accessible diagnostic solutions to changing healthcare needs. One such trend is the expansion in testing capabilities at the point of care, enabling quick decentralized diagnostics results. The use of modern technologies is one factor behind market trends in POCT. Smaller sizes of machinery-driven integration with digital platforms count among significant developments made so far toward improving nature diagnostics products. Portable analyzers, handheld devices, and smartphone-based applications are now common, providing quick, accurate tests for different medical conditions. Apart from facilitating testing efficiencies, these innovations provide healthcare services in varied settings. Such a trend also exists in POCT, where diagnosing beyond infectious diseases has been extended to chronic conditions. These include diabetes, cardiovascular diseases, and cancer markers; thus, there are POC devices that offer rapid diagnosis for them, too. The adoption of decentralized diagnostic networks is another emerging pattern within this marketplace. In this regard, POCT systems become part of bigger diagnostic networks that facilitate data sharing without interruptions or breaks, hence ensuring continuous result reporting. This trend correspondingly aligns with the wider acceptance of digital health solutions, thereby creating a more interconnected data-driven procedure that deals with patients. Decentralized networks promote cooperation among healthcare providers and improve patient management by means of real-time information sharing. POCT is driven by affordability and access, which shapes its market dynamics. Since cost-effective diagnostics are in demand, affordable POCT devices have been developed to suit various healthcare settings, including resource-poor areas. In efforts to make healthcare more inclusive, governments, organizations, and manufacturers focus on producing affordable POCT technologies aimed at increasing the availability of diagnostics worldwide in different locations. Furthermore, the COVID-19 pandemic has had an impact on POCT market trends. The need for decentralized testing solutions was underscored during the pandemic when there was a great demand for quick and widespread testing. Rapid antigen tests, as well as molecular diagnostics, were used in mass testing efforts, contact tracing, and containment of the virus, hence playing a crucial role. Prompt diagnosis was made possible through POCT devices like rapid antigen tests along with other molecular diagnostics, which formed an integral part of the national COVID-19 response, including large-scale contact tracing initiatives that helped curb further spread. The experience taught us how POC technologies are adaptive; therefore, they provide enough resilience even during moments of public health crises.

Leave a Comment