Health and Wellness Trends

The Plant-Based Food Ingredients Market is significantly influenced by the rising health and wellness trends among consumers. As individuals become more health-conscious, they are gravitating towards foods that are perceived as healthier options. Plant-based ingredients are often associated with lower calorie counts, higher fiber content, and essential nutrients, which appeal to health-oriented consumers. Market data indicates that the demand for plant-based proteins has increased by over 20% in recent years, reflecting a shift in consumer preferences. This trend suggests that the Plant-Based Food Ingredients Market is likely to benefit from the ongoing focus on health and wellness, as more consumers seek to incorporate nutritious plant-based options into their diets.

Environmental Concerns and Sustainability

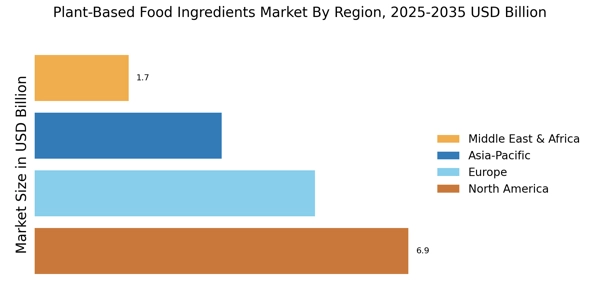

The Plant-Based Food Ingredients Market is increasingly shaped by environmental concerns and the demand for sustainable food sources. As awareness of climate change and its impacts grows, consumers are more inclined to choose products that have a lower environmental footprint. Plant-based ingredients typically require fewer resources, such as water and land, compared to animal-based products. Recent studies indicate that plant-based diets can reduce greenhouse gas emissions by up to 50%. This growing emphasis on sustainability is likely to drive innovation and investment in the Plant-Based Food Ingredients Market, as companies strive to meet the expectations of environmentally conscious consumers.

Regulatory Support and Policy Initiatives

The Plant-Based Food Ingredients Market is also influenced by regulatory support and policy initiatives aimed at promoting healthier eating habits. Governments in various regions are implementing policies that encourage the consumption of plant-based foods, recognizing their potential benefits for public health and the environment. For instance, subsidies for plant-based agriculture and educational campaigns about the benefits of plant-based diets are becoming more common. This regulatory environment is likely to foster growth in the Plant-Based Food Ingredients Market, as it creates a more favorable landscape for producers and consumers alike. The alignment of policy with consumer trends suggests a robust future for plant-based food ingredients.

Technological Advancements in Food Production

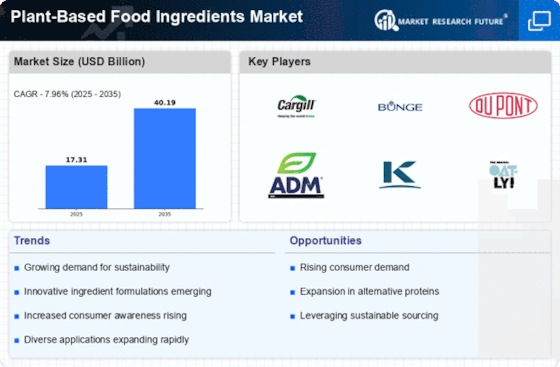

The Plant-Based Food Ingredients Market is benefiting from technological advancements in food production processes. Innovations such as precision fermentation and advanced extraction techniques are enhancing the quality and variety of plant-based ingredients available. These technologies enable manufacturers to create products that closely mimic the taste and texture of traditional animal-based foods, thereby appealing to a broader audience. Market analysis suggests that the adoption of these technologies could lead to a significant increase in the availability of plant-based options, potentially doubling the market size within the next decade. This evolution indicates a promising future for the Plant-Based Food Ingredients Market as it adapts to consumer preferences.

Increasing Consumer Demand for Plant-Based Products

The Plant-Based Food Ingredients Market is experiencing a notable surge in consumer demand for plant-based products. This trend is driven by a growing awareness of health benefits associated with plant-based diets, including lower risks of chronic diseases. According to recent data, the plant-based food sector has seen a compound annual growth rate of approximately 11% over the past few years. Consumers are increasingly seeking alternatives to animal-based products, which has led to a diversification of offerings in the market. This shift is not merely a trend but appears to be a fundamental change in dietary preferences, suggesting that the Plant-Based Food Ingredients Market will continue to expand as more individuals adopt plant-based lifestyles.