Plant-Based Food & Beverages Market Summary

As per Market Research Future analysis, the Plant-Based Food & Beverages Market was estimated at 26.38 USD Billion in 2024. The Plant-Based Food & Beverages industry is projected to grow from 28.76 USD Billion in 2025 to 68.14 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.01% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Plant-Based Food and Beverages Market is experiencing robust growth driven by health consciousness and sustainability.

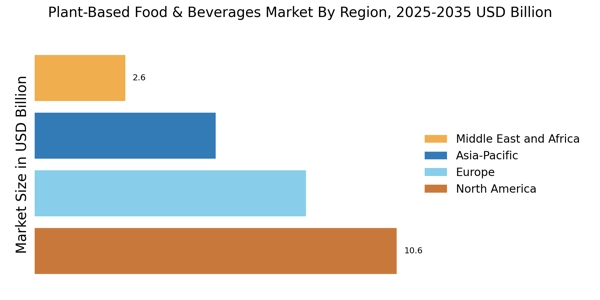

- North America remains the largest market for plant-based foods, reflecting a strong consumer shift towards healthier options.

- The Asia-Pacific region is emerging as the fastest-growing market, indicating a rising demand for plant-based alternatives.

- Plant-based milk continues to dominate the market, while plant-based meat is witnessing the fastest growth due to innovative product offerings.

- Health consciousness and sustainability focus are key drivers propelling the market forward, appealing to diverse consumer demographics.

Market Size & Forecast

| 2024 Market Size | 26.38 (USD Billion) |

| 2035 Market Size | 68.14 (USD Billion) |

| CAGR (2025 - 2035) | 9.01% |

Major Players

Beyond Meat (US), Impossible Foods (US), Oatly (SE), Alpro (BE), Tofurky (US), Quorn (GB), Daiya Foods (CA), Silk (US), Earth Balance (US), Miyoko's Creamery (US)