Growing Environmental Awareness

Environmental concerns are increasingly shaping consumer preferences within the plant based-food-beverages market. As awareness of climate change and its impacts grows, consumers are more inclined to choose products that align with their values regarding sustainability. A 2025 report indicates that 70% of consumers consider the environmental impact of their food choices, with many opting for plant-based options as a means to reduce their carbon footprint. This trend is likely to drive innovation and investment in sustainable practices within the industry, as companies strive to meet the expectations of environmentally conscious consumers. The potential for growth in this sector is substantial, as the market adapts to these evolving consumer demands.

Influence of Social Media and Marketing

The role of social media and targeted marketing strategies cannot be overlooked in the plant based-food-beverages market. Influencers and health advocates are increasingly promoting plant-based diets, which has led to a rise in consumer interest and engagement. In 2025, social media campaigns focusing on plant-based lifestyles have shown to increase product sales by up to 30%. This digital influence is particularly strong among younger demographics, who are more likely to seek out and share information about plant-based options. As brands leverage these platforms to connect with consumers, the visibility and appeal of plant-based products are expected to grow, further driving market expansion.

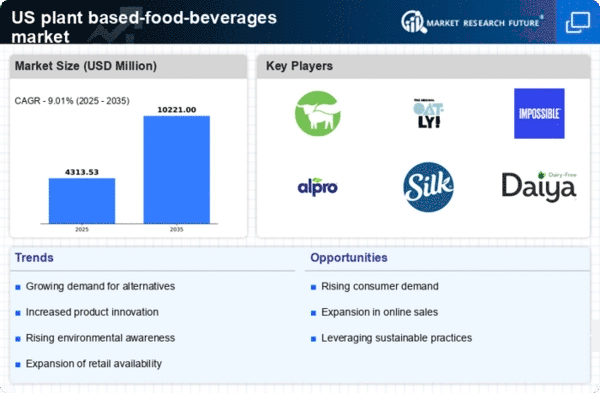

Rising Demand for Plant-Based Alternatives

The plant based-food-beverages market is experiencing a notable surge in demand for alternatives to traditional animal-based products. This shift is largely driven by consumers seeking healthier options, as evidenced by a 2025 survey indicating that 60% of respondents are actively reducing their meat consumption. The increasing awareness of the health benefits associated with plant-based diets, such as lower cholesterol levels and reduced risk of chronic diseases, is propelling this trend. Furthermore, the market is projected to reach $74 billion by 2027, reflecting a compound annual growth rate (CAGR) of 11%. This growth is indicative of a broader societal shift towards plant-based eating, which is likely to continue influencing the plant based-food-beverages market in the coming years.

Regulatory Support for Plant-Based Products

Regulatory frameworks are evolving to support the growth of the plant based-food-beverages market. In recent years, various state and federal initiatives have been introduced to promote plant-based agriculture and food production. For instance, grants and subsidies aimed at farmers transitioning to plant-based crops are becoming more common, which could enhance supply chain stability. Additionally, labeling regulations that clarify the benefits of plant-based products are likely to improve consumer trust and understanding. As these regulatory measures take effect, they may bolster the market by encouraging more producers to enter the plant-based sector, thereby increasing competition and innovation.

Increased Availability of Plant-Based Products

The expansion of the plant based-food-beverages market is significantly influenced by the increased availability of plant-based products across various retail channels. Major grocery chains and specialty stores are now dedicating more shelf space to plant-based options, making them more accessible to consumers. In 2025, it is estimated that plant-based products account for approximately 15% of total grocery sales in the US. This accessibility is crucial, as it encourages trial and adoption among consumers who may have previously been hesitant. Additionally, the rise of e-commerce platforms has further facilitated access to a diverse range of plant-based products, thereby enhancing the overall market landscape.