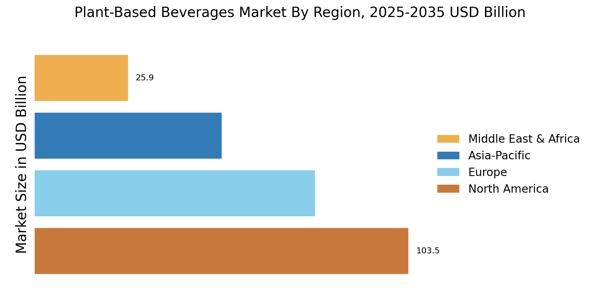

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America Plant-Based Beverages Market accounted for USD 100.66 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. The demand for plant-based beverages in North America is driven by health and wellness trends, environmental concerns, and the rise of veganism and vegetarianism. The popularity of plant-based milk alternatives, such as almond milk and soy milk, is also contributing to the growth of the market.

The region is home to several major plant-based beverage manufacturers, including Silk, So Delicious, and Califia Farms. U.S. being the biggest contributor to the market.

Further, the major countries studied in the market report are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe Plant-Based Beverages Market accounts for the second-largest market share due to the health and wellness trends and environmental concerns. Soy milk and almond milk are the most popular plant-based milk alternatives in Europe. The region is also home to several major plant-based beverage manufacturers, including Alpro, Oatly, and Innocent. Further, the Germany Plant-Based Beverages Market held the largest market share, and the UK Plant-Based Beverages Market was the fastest growing market in the European region, reinforcing the growth of the Europe plant based beverages market.

The Asia-Pacific Plant-Based Beverages Market is expected to grow at the fastest CAGR from 2022 to 2030. The Asia-Pacific Plant-Based Beverages Market is driven by increasing consumer awareness of the health and environmental benefits of plant-based products. The region is home to several large and emerging markets, including China, Japan, India, and Australia. Soy milk and almond milk are the most popular plant-based milk alternatives in the region, but other types of plant-based beverages, such as coconut milk and rice milk, are also gaining popularity.

The region is home to several major plant-based beverage manufacturers, including Vitasoy International Holdings Ltd, Sanitarium Health and Wellbeing Company, and Nestle S.A. Moreover, the china plant based beverages market held the largest market share, and the India plant-based beverages market was the fastest growing market in the Asia-Pacific region.

Further, the major countries studied in the market report include Brazil, where the brazil plant based beverages market is witnessing steady growth due to rising health awareness and increasing adoption of dairy-free alternatives.