Increasing Demand for Energy Security

The Pipeline Integrity Market is experiencing heightened demand for energy security, driven by the need to ensure reliable and safe transportation of oil and gas. As geopolitical tensions and supply chain vulnerabilities persist, countries are investing in infrastructure to bolster energy independence. This trend is reflected in the projected market value of 2.22 USD Billion in 2024, as stakeholders prioritize the integrity of pipelines to prevent leaks and failures. Enhanced monitoring technologies and maintenance practices are being adopted to mitigate risks, thereby fostering a more resilient energy supply chain globally.

Aging Infrastructure and Maintenance Needs

The aging infrastructure of pipeline systems presents a critical challenge and opportunity within the Pipeline Integrity Market. Many pipelines, particularly in developed regions, are reaching the end of their operational lifespan, necessitating urgent maintenance and upgrades. This situation is prompting investments in integrity management programs to assess and rehabilitate aging assets. The market's growth trajectory is influenced by the need for proactive maintenance strategies that can extend the life of these infrastructures. As companies address these challenges, the demand for integrity solutions is expected to rise, contributing to the overall market expansion.

Technological Advancements in Monitoring Systems

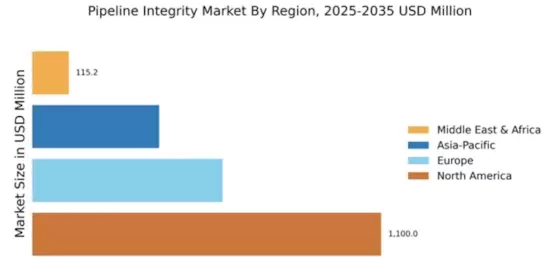

Technological advancements are revolutionizing the Global Pipeline Integrity Market, particularly in monitoring systems. Innovations such as real-time data analytics, artificial intelligence, and machine learning are enabling operators to detect anomalies and predict failures before they occur. These technologies enhance the overall safety and efficiency of pipeline operations, reducing downtime and maintenance costs. As the industry embraces these advancements, the market is projected to grow at a CAGR of 4.33% from 2025 to 2035. The integration of these cutting-edge solutions is likely to transform traditional pipeline management practices, ensuring greater integrity and reliability.

Regulatory Compliance and Environmental Standards

Stringent regulatory frameworks and environmental standards are propelling the Pipeline Integrity Industry forward. Governments worldwide are implementing policies that mandate regular inspections and maintenance of pipeline systems to minimize environmental impacts. Compliance with these regulations not only ensures safety but also enhances public trust in energy companies. As a result, the market is expected to grow, reaching 3.54 USD Billion by 2035. Companies are increasingly investing in advanced technologies such as smart sensors and data analytics to meet these compliance requirements, thereby driving innovation and efficiency in pipeline management.

Growing Investment in Renewable Energy Infrastructure

The transition towards renewable energy sources is influencing the Pipeline Integrity Market. As countries invest in renewable energy infrastructure, the need for efficient and secure transportation of biofuels and hydrogen is emerging. This shift not only diversifies energy portfolios but also necessitates the implementation of robust pipeline integrity measures to ensure safety and reliability. The market is likely to see increased investments in technologies that support the integrity of these new pipeline systems. This evolving landscape presents both challenges and opportunities for stakeholders, as they adapt to the changing energy paradigm.