Growing Demand for Energy Security

The increasing focus on energy security in Canada is driving the pipeline integrity market. As energy demands rise, the need for reliable and safe transportation of oil and gas becomes paramount. The Canadian government has emphasized the importance of maintaining pipeline infrastructure to ensure uninterrupted energy supply. This has led to investments in technologies that enhance pipeline monitoring and maintenance. In 2024, the Canadian pipeline integrity market was valued at approximately $1.5 billion, with projections indicating a growth rate of around 6% annually. This trend suggests that stakeholders are prioritizing the integrity of pipelines to mitigate risks associated with leaks and failures, thereby reinforcing the market's growth.

Aging Infrastructure and Maintenance Needs

The aging pipeline infrastructure in Canada presents a significant driver for the pipeline integrity market. Many pipelines were constructed several decades ago and are now facing challenges related to wear and tear. This necessitates regular inspections and maintenance to prevent failures and ensure safety. The Canadian Energy Regulator has reported that approximately 30% of pipelines are over 30 years old, highlighting the urgent need for integrity management solutions. As operators seek to extend the lifespan of their assets, investments in advanced inspection technologies and maintenance practices are becoming increasingly common. This trend is likely to bolster the pipeline integrity market as companies strive to enhance operational efficiency and safety.

Technological Integration and Digital Transformation

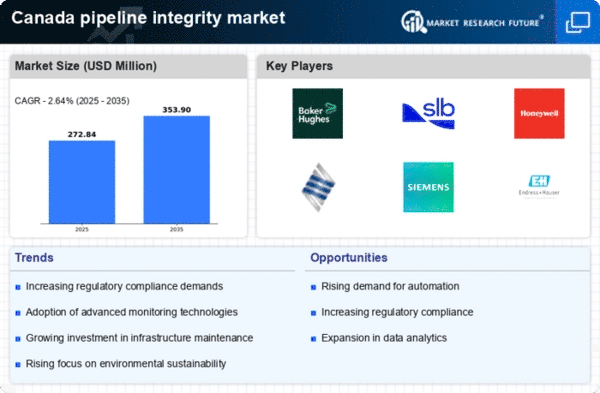

The integration of advanced technologies is reshaping the pipeline integrity market in Canada. Digital transformation initiatives are enabling companies to leverage data analytics, artificial intelligence, and IoT for enhanced monitoring and predictive maintenance. These technologies facilitate real-time data collection and analysis, allowing for proactive decision-making regarding pipeline integrity. The Canadian pipeline integrity market is expected to benefit from these advancements, as they improve operational efficiency and reduce downtime. In 2025, it is anticipated that the adoption of digital solutions will account for nearly 40% of the market, reflecting a significant shift towards technology-driven approaches in ensuring pipeline safety and reliability.

Environmental Concerns and Sustainability Initiatives

Environmental considerations are increasingly influencing the pipeline integrity market in Canada. With heightened awareness of climate change and ecological impacts, there is a strong push for sustainable practices in the energy sector. Regulatory bodies are mandating stricter environmental assessments and monitoring protocols for pipeline operations. This has resulted in the adoption of advanced technologies that not only ensure compliance but also promote sustainability. The market is witnessing a shift towards eco-friendly materials and methods, which could potentially reduce the environmental footprint of pipeline operations. As a result, companies are investing in innovative solutions that align with sustainability goals, thereby enhancing their market position.

Increased Regulatory Scrutiny and Compliance Requirements

The pipeline integrity market in Canada is experiencing heightened regulatory scrutiny, which is driving demand for compliance solutions. Regulatory agencies are implementing more stringent guidelines to ensure the safety and integrity of pipeline operations. This has led to an increase in the need for comprehensive monitoring systems and reporting mechanisms. Companies are now required to demonstrate compliance with various safety standards, which has resulted in a surge in investments in integrity management technologies. The market is projected to grow as organizations seek to meet these evolving regulatory demands, with compliance-related expenditures expected to rise by approximately 15% over the next five years.