Rising Demand for Energy Resources

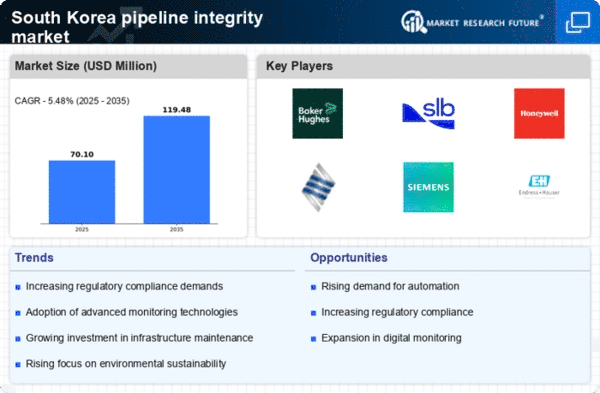

The increasing demand for energy resources in South Korea is a significant driver for the pipeline integrity market. As the nation seeks to diversify its energy portfolio, the reliance on natural gas and other energy sources is expected to grow. This shift necessitates the development of new pipelines and the maintenance of existing ones to ensure efficient transportation. According to recent data, the natural gas consumption in South Korea is projected to rise by 5% annually, further emphasizing the need for stringent pipeline integrity measures. The pipeline integrity market is likely to benefit from this trend, as operators invest in technologies and practices that enhance the safety and reliability of their pipeline systems, thereby addressing the challenges posed by increased energy demands.

Focus on Risk Management Strategies

In the context of the pipeline integrity market, there is a growing emphasis on risk management strategies among operators in South Korea. The need to identify, assess, and mitigate risks associated with pipeline operations has become increasingly critical, particularly in light of environmental concerns and potential safety hazards. Companies are adopting comprehensive risk management frameworks that incorporate advanced monitoring technologies and data analytics to enhance decision-making processes. This proactive approach not only helps in maintaining compliance with regulatory requirements but also fosters a culture of safety within organizations. As a result, the The pipeline integrity market is likely to see an uptick in demand for risk assessment tools and services. These tools are essential for ensuring the long-term sustainability of pipeline operations.

Increasing Infrastructure Investment

The pipeline integrity market in South Korea is experiencing a surge in infrastructure investment, driven by the government's commitment to enhance energy security and modernize existing pipeline systems. With an estimated investment of $10 billion allocated for pipeline upgrades and expansions over the next five years, the industry is poised for growth. This influx of capital is likely to facilitate the adoption of advanced technologies and materials, thereby improving the overall integrity of pipeline networks. As the demand for energy continues to rise, the need for reliable and safe transportation of resources becomes paramount. Consequently, this trend is expected to bolster the pipeline integrity market, as stakeholders prioritize the implementation of robust integrity management programs to mitigate risks associated with aging infrastructure.

Technological Integration in Operations

The integration of advanced technologies into pipeline operations is transforming the landscape of the pipeline integrity market in South Korea. Innovations such as smart sensors, drones, and artificial intelligence are being increasingly utilized to monitor pipeline conditions and detect potential issues in real-time. This technological evolution is expected to enhance the efficiency and effectiveness of integrity management practices, allowing for timely interventions and reducing the likelihood of failures. As companies recognize the value of data-driven insights, investments in these technologies are anticipated to rise. The pipeline integrity market stands to gain from this trend, as operators seek to leverage technology to optimize their operations and ensure the safety and reliability of their pipeline systems.

Environmental Regulations and Compliance

The pipeline integrity market is significantly influenced by stringent environmental regulations in South Korea. The government has implemented various policies aimed at minimizing the environmental impact of pipeline operations, which necessitates compliance from industry players. This regulatory landscape compels companies to invest in integrity management solutions that not only meet legal requirements but also promote sustainable practices. As environmental awareness continues to grow among consumers and stakeholders, the pressure on companies to adopt eco-friendly technologies and processes is likely to increase. Consequently, the pipeline integrity market may experience a shift towards solutions that prioritize environmental stewardship, thereby aligning operational practices with broader sustainability goals.