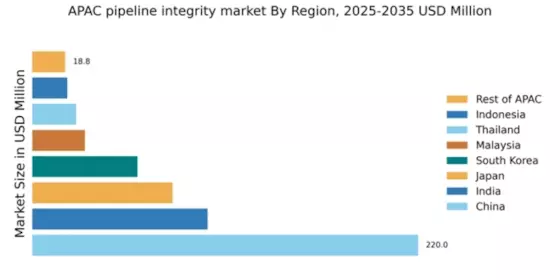

China : Robust Growth Driven by Demand

China holds a commanding market share of 220.0, representing a significant portion of the APAC pipeline integrity market. Key growth drivers include rapid industrialization, increased energy demand, and stringent regulatory policies aimed at enhancing safety and environmental standards. The government has initiated various infrastructure projects, including the Belt and Road Initiative, which further boosts demand for pipeline integrity solutions. Consumption patterns reflect a shift towards advanced monitoring technologies and automation in pipeline management.

India : Strong Demand from Energy Sector

India's pipeline integrity market is valued at 100.0, driven by increasing investments in oil and gas infrastructure. The government's push for energy independence and initiatives like the Pradhan Mantri Ujjwala Yojana are key growth factors. Demand trends indicate a rising need for advanced monitoring systems and maintenance solutions, particularly in urban areas. Regulatory frameworks are evolving to enhance safety standards, promoting the adoption of innovative technologies in pipeline management.

Japan : Focus on Safety and Efficiency

Japan's market, valued at 80.0, is characterized by a strong emphasis on safety and technological innovation. The country's aging infrastructure necessitates upgrades and maintenance, driving demand for pipeline integrity solutions. Government initiatives aimed at disaster preparedness and environmental protection further support market growth. Consumption patterns reflect a preference for high-tech monitoring systems and predictive maintenance solutions, aligning with Japan's advanced industrial landscape.

South Korea : Growing Demand for Monitoring Systems

With a market value of 60.0, South Korea is witnessing significant growth in pipeline integrity solutions, driven by extensive infrastructure development and urbanization. The government's focus on energy efficiency and safety regulations is propelling demand for advanced monitoring technologies. Key cities like Seoul and Busan are central to this growth, with major projects underway. The competitive landscape includes strong players like Siemens and Honeywell, who are adapting to local market needs and regulatory requirements.

Malaysia : Investment in Oil and Gas Sector

Malaysia's pipeline integrity market, valued at 30.0, is bolstered by substantial investments in the oil and gas sector. The government's initiatives to enhance energy security and sustainability are key growth drivers. Demand trends indicate a shift towards integrated monitoring solutions, particularly in regions like Sarawak and Sabah. The competitive landscape features both local and international players, with a focus on compliance with local regulations and environmental standards.

Thailand : Focus on Safety and Compliance

Thailand's market, valued at 25.0, is experiencing growth due to increasing pipeline infrastructure projects and regulatory compliance requirements. The government's commitment to enhancing energy security and safety standards is driving demand for pipeline integrity solutions. Key regions include Bangkok and the Eastern Economic Corridor, where industrial activities are concentrated. The competitive landscape includes major players like Emerson and T.D. Williamson, who are adapting to local market dynamics.

Indonesia : Investment in Energy Infrastructure

Indonesia's pipeline integrity market, valued at 20.0, is expanding due to significant investments in energy infrastructure and regulatory reforms. The government's focus on improving energy access and sustainability is a key growth driver. Demand trends indicate a rising need for monitoring and maintenance solutions, particularly in regions like Java and Sumatra. The competitive landscape features both local and international players, with a focus on compliance with environmental regulations and safety standards.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC market, valued at 18.8, encompasses diverse dynamics influenced by varying regulatory environments and industrial needs. Growth is driven by localized infrastructure projects and energy demands. Countries like Vietnam and the Philippines are emerging markets with increasing investments in pipeline integrity solutions. The competitive landscape is fragmented, with both regional and The pipeline integrity market share, adapting to local conditions and regulatory frameworks.