Organic Drinks Market Summary

As per Market Research Future analysis, the Organic Drinks Market Size was estimated at 21.54 USD Billion in 2024. The Organic Drinks industry is projected to grow from 23.97 USD Billion in 2025 to 69.95 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Organic Drinks Market is experiencing robust growth driven by health consciousness and sustainability trends.

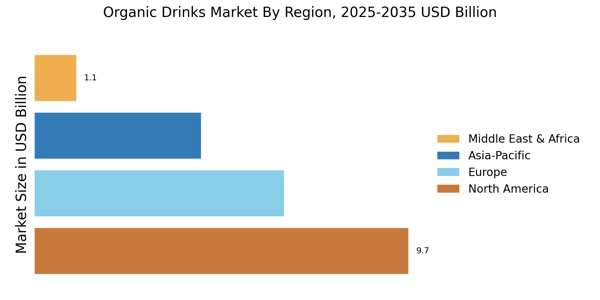

- The North American region remains the largest market for organic drinks, reflecting a strong health and wellness focus among consumers.

- In contrast, the Asia-Pacific region is emerging as the fastest-growing market, driven by evolving consumer preferences for organic products.

- The non-alcoholic segment continues to dominate the market, while the alcoholic segment is witnessing rapid growth due to innovative flavor profiles.

- Key market drivers include rising health consciousness and sustainability trends, which are shaping consumer choices in both store-based and non-store-based segments.

Market Size & Forecast

| 2024 Market Size | 21.54 (USD Billion) |

| 2035 Market Size | 69.95 (USD Billion) |

| CAGR (2025 - 2035) | 11.3% |

Major Players

Coca-Cola (US), PepsiCo (US), Nestle (CH), Danone (FR), Unilever (GB), Monster Beverage Corporation (US), Kraft Heinz (US), Hain Celestial Group (US), Organic Valley (US)