Health Consciousness

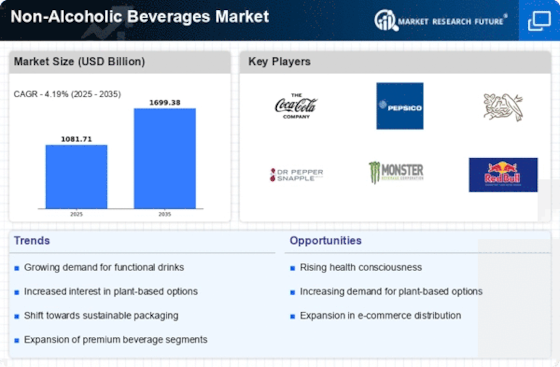

The increasing awareness of health and wellness among consumers appears to be a primary driver of the Non-alcoholic beverages Market. As individuals become more health-conscious, they tend to seek alternatives to sugary and alcoholic drinks. This shift is reflected in the rising demand for beverages that are low in sugar, organic, and fortified with vitamins and minerals. According to recent data, the market for health-oriented non-alcoholic beverages is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 8% over the next five years. This trend suggests that manufacturers are likely to innovate and expand their product lines to cater to this growing segment, thereby enhancing their market presence.

Diverse Flavor Profiles

The demand for diverse and unique flavor profiles is reshaping the Non-Alcoholic Beverages Market. Consumers are increasingly seeking novel taste experiences, prompting manufacturers to experiment with exotic ingredients and innovative flavor combinations. This trend is particularly evident in the rise of craft sodas, flavored waters, and herbal teas, which cater to adventurous palates. Market data indicates that beverages featuring unique flavors are gaining traction, with sales in this category expected to rise by over 10% in the coming years. This suggests that companies focusing on flavor innovation may capture a larger share of the market, appealing to consumers looking for alternatives to traditional offerings.

Sustainability Initiatives

Sustainability has emerged as a crucial factor influencing consumer choices in the Non-Alcoholic Beverages Market. As environmental concerns gain traction, consumers increasingly prefer brands that demonstrate a commitment to sustainable practices. This includes the use of eco-friendly packaging, responsible sourcing of ingredients, and transparent supply chains. Companies that adopt sustainable practices not only appeal to environmentally conscious consumers but also position themselves favorably in a competitive market. Recent statistics indicate that brands emphasizing sustainability have seen a notable increase in sales, suggesting that this trend is likely to continue shaping the industry landscape. The integration of sustainability into business models may also lead to long-term cost savings and enhanced brand loyalty.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of modern consumers is driving the demand for convenience in the Non-Alcoholic Beverages Market. As individuals seek quick and easy options, ready-to-drink beverages are becoming increasingly popular. This trend is reflected in the growth of single-serve packaging and portable formats, which cater to on-the-go consumption. Recent market analysis shows that the ready-to-drink segment is expected to witness a CAGR of around 7% over the next few years. This indicates that companies focusing on convenience-oriented products may find substantial opportunities for growth, as they align with the evolving preferences of busy consumers.

Digital Marketing and E-commerce Growth

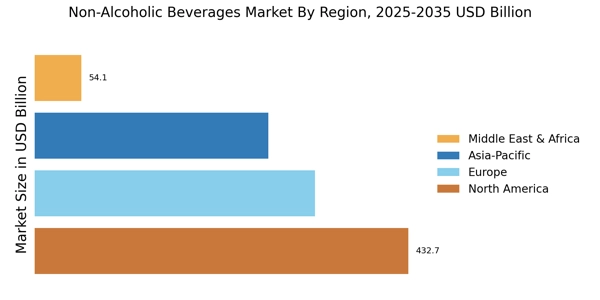

The rise of digital marketing and e-commerce platforms is transforming the Non-Alcoholic Beverages Market. As consumers increasingly turn to online shopping, brands are leveraging digital channels to reach their target audiences more effectively. This shift has led to a surge in direct-to-consumer sales, allowing companies to build stronger relationships with their customers. Data suggests that e-commerce sales in the non-alcoholic beverage sector are projected to grow by over 15% annually, indicating a significant shift in purchasing behavior. This trend suggests that businesses that invest in digital marketing strategies and enhance their online presence may gain a competitive edge in the market.