Health Consciousness

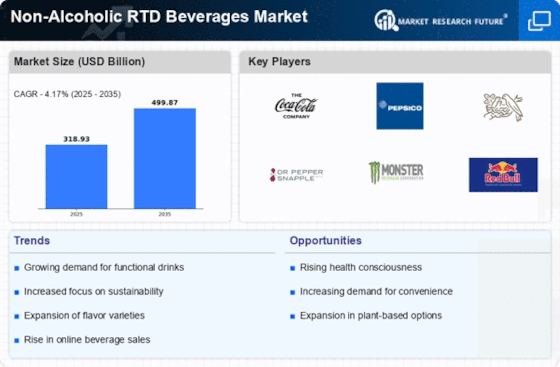

The increasing awareness of health and wellness among consumers appears to be a primary driver for the Non-Alcoholic RTD Beverages Market. As individuals become more health-conscious, they tend to seek alternatives to sugary and alcoholic beverages. This shift is reflected in the rising demand for beverages that are low in calories, sugar-free, and enriched with vitamins and minerals. According to recent data, the market for health-oriented non-alcoholic beverages is projected to grow significantly, with a notable increase in sales of functional drinks. This trend suggests that manufacturers are likely to innovate and expand their product lines to cater to this health-driven consumer base, thereby enhancing their market presence.

Sustainability Trends

Sustainability has emerged as a crucial factor influencing consumer choices in the Non-Alcoholic RTD Beverages Market. As environmental concerns gain traction, consumers are increasingly favoring brands that prioritize eco-friendly practices, such as sustainable sourcing and recyclable packaging. This shift is evident in the growing number of companies that are adopting green initiatives, which not only appeal to environmentally conscious consumers but also enhance brand loyalty. Market data indicates that beverages marketed as sustainable are witnessing higher sales growth compared to traditional options. This trend suggests that companies that align their practices with sustainability goals may experience a competitive advantage in the evolving beverage landscape.

Diverse Flavor Profiles

The demand for diverse and unique flavor profiles is reshaping the Non-Alcoholic RTD Beverages Market. Consumers are increasingly seeking novel taste experiences, prompting manufacturers to experiment with exotic ingredients and innovative combinations. This trend is reflected in the rising popularity of beverages infused with botanicals, spices, and superfoods. Market analysis shows that products featuring unique flavors are gaining traction, with a significant portion of consumers willing to pay a premium for these offerings. This inclination towards flavor exploration indicates that brands that invest in flavor innovation may capture a larger share of the market, appealing to adventurous consumers.

Innovative Marketing Strategies

Innovative marketing strategies are playing a pivotal role in shaping the Non-Alcoholic RTD Beverages Market. As competition intensifies, brands are leveraging creative campaigns to engage consumers and differentiate themselves. This includes the use of social media, influencer partnerships, and experiential marketing to create memorable brand experiences. Recent trends indicate that companies employing innovative marketing tactics are achieving higher brand recognition and consumer loyalty. This suggests that brands that effectively communicate their unique value propositions and connect with their target audience may enhance their market position and drive sales growth.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of modern consumers is driving the demand for convenience in the Non-Alcoholic RTD Beverages Market. As individuals seek quick and easy options, ready-to-drink beverages are becoming increasingly popular. This trend is particularly evident among busy professionals and health-conscious individuals who prefer portable and hassle-free drink options. Market data suggests that the convenience segment is experiencing robust growth, with a notable increase in sales of single-serve packaging. This indicates that brands focusing on convenience and portability may find substantial opportunities for expansion in this dynamic market.