Health Consciousness

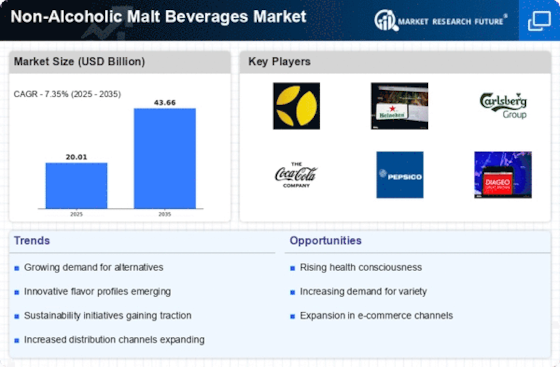

The increasing awareness of health and wellness among consumers appears to be a pivotal driver for the Non-Alcoholic Malt Beverages Market. As individuals become more health-conscious, they tend to seek alternatives to traditional alcoholic beverages. This shift is reflected in the rising demand for non-alcoholic options that offer similar taste profiles without the adverse effects of alcohol. According to recent data, the non-alcoholic beverage segment has witnessed a growth rate of approximately 7% annually, indicating a robust market potential. Consumers are increasingly opting for beverages that are perceived as healthier, leading to a surge in product innovation within the Non-Alcoholic Malt Beverages Market. Manufacturers are responding by developing malt beverages that are low in sugar and calories, catering to the evolving preferences of health-oriented consumers.

Premiumization Trend

The trend of premiumization is significantly influencing the Non-Alcoholic Malt Beverages Market. Consumers are increasingly willing to pay a premium for high-quality, artisanal products that offer unique flavors and experiences. This trend is evident in the growing number of craft non-alcoholic malt beverages that emphasize quality ingredients and innovative brewing techniques. Market data suggests that premium non-alcoholic beverages are projected to grow at a rate of 10% over the next five years, outpacing standard offerings. This shift towards premium products indicates a changing consumer mindset, where quality is prioritized over quantity. As a result, brands within the Non-Alcoholic Malt Beverages Market are focusing on enhancing their product offerings to meet the demands of discerning consumers who seek authenticity and sophistication in their beverage choices.

Social Media Influence

The impact of social media on consumer behavior is becoming increasingly pronounced within the Non-Alcoholic Malt Beverages Market. Platforms such as Instagram and TikTok serve as powerful tools for brands to engage with consumers, showcasing their products in visually appealing ways. This digital engagement has led to heightened brand awareness and consumer interest in non-alcoholic options. Recent studies indicate that brands leveraging social media marketing strategies have experienced a 15% increase in sales compared to those that do not. The ability to create viral content and connect with a younger audience is reshaping the landscape of the Non-Alcoholic Malt Beverages Market. As consumers share their experiences and preferences online, the demand for innovative and trendy non-alcoholic malt beverages continues to rise, prompting brands to adapt their marketing strategies accordingly.

Diverse Flavor Profiles

The introduction of diverse flavor profiles is emerging as a key driver in the Non-Alcoholic Malt Beverages Market. Consumers are increasingly seeking unique and adventurous taste experiences, prompting manufacturers to innovate beyond traditional malt flavors. This trend is reflected in the growing popularity of beverages infused with exotic ingredients, herbs, and spices. Market analysis indicates that products featuring innovative flavor combinations are likely to capture a larger market share, as they appeal to consumers' desire for novelty. The Non-Alcoholic Malt Beverages Market is witnessing a surge in the development of beverages that cater to diverse palates, thereby enhancing consumer engagement and satisfaction. As brands continue to experiment with flavors, the potential for growth in this segment appears promising, suggesting a dynamic evolution in consumer preferences.

Sustainability Initiatives

Sustainability initiatives are increasingly shaping the Non-Alcoholic Malt Beverages Market. As environmental concerns gain prominence, consumers are gravitating towards brands that prioritize eco-friendly practices. This shift is prompting manufacturers to adopt sustainable sourcing, packaging, and production methods. Recent data indicates that approximately 60% of consumers are willing to pay more for products that are environmentally friendly. This trend is influencing the development of non-alcoholic malt beverages that utilize organic ingredients and sustainable packaging solutions. The Non-Alcoholic Malt Beverages Market is likely to benefit from this growing emphasis on sustainability, as brands that align with these values may enhance their market positioning and appeal to a conscientious consumer base. As sustainability becomes a core value for many consumers, the potential for growth in this sector appears substantial.