Rising Complexity of IT Environments

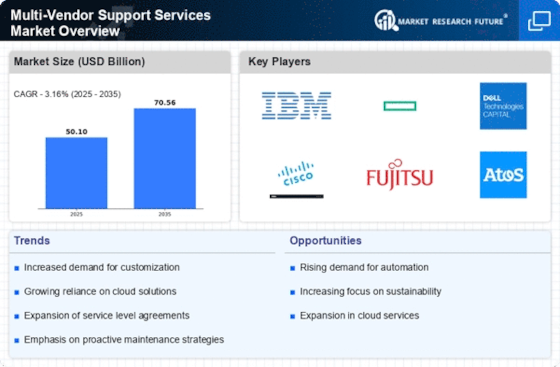

The increasing complexity of IT environments is a primary driver for the Multi-Vendor Support Services Market. Organizations are adopting diverse technologies and platforms, leading to intricate systems that require specialized support. As businesses integrate various hardware and software solutions, the need for multi-vendor support becomes apparent. This complexity necessitates a coordinated approach to manage different vendors effectively. According to industry reports, the demand for multi-vendor support services is projected to grow at a compound annual growth rate of 12% over the next five years. This growth indicates that organizations are increasingly recognizing the value of streamlined support services that can handle multiple vendors, thereby enhancing operational efficiency and reducing downtime.

Increased Focus on Customer Experience

The emphasis on enhancing customer experience is driving the Multi-Vendor Support Services Market. Companies are increasingly aware that superior customer service can differentiate them in competitive markets. Multi-vendor support services enable organizations to provide seamless and efficient support across various platforms, which is crucial for maintaining customer satisfaction. By integrating support from multiple vendors, businesses can ensure that they address customer issues promptly and effectively. Research indicates that organizations that prioritize customer experience see a 20% increase in customer retention rates. This trend suggests that the demand for multi-vendor support services will continue to rise as companies seek to improve their service delivery and customer engagement.

Cost Efficiency and Resource Optimization

Cost efficiency remains a significant driver for the Multi-Vendor Support Services Market. Organizations are continually seeking ways to optimize their IT budgets while maintaining high service levels. By leveraging multi-vendor support services, companies can consolidate their support needs, potentially reducing costs associated with managing multiple contracts and service providers. This approach allows for better resource allocation and can lead to substantial savings. Market analysis suggests that businesses utilizing multi-vendor support services can achieve up to 30% cost reduction in their IT support expenditures. As organizations strive to maximize their return on investment, the appeal of cost-effective multi-vendor solutions is likely to grow.

Regulatory Compliance and Risk Management

Regulatory compliance is becoming increasingly complex, serving as a key driver for the Multi-Vendor Support Services Market. Organizations must navigate a myriad of regulations that govern data security, privacy, and operational standards. Multi-vendor support services can assist businesses in ensuring compliance across various platforms and technologies. By engaging specialized support, companies can mitigate risks associated with non-compliance, which can lead to significant financial penalties. The market for compliance-related services is expected to grow, with estimates suggesting a 15% increase in demand for compliance support services over the next few years. This trend indicates that organizations are prioritizing risk management, further fueling the need for multi-vendor support solutions.

Technological Advancements and Innovation

Technological advancements are a driving force behind the Multi-Vendor Support Services Market. As new technologies emerge, organizations face the challenge of integrating these innovations into their existing systems. Multi-vendor support services provide the expertise needed to navigate these changes effectively. The rapid pace of technological evolution, including cloud computing, artificial intelligence, and IoT, necessitates a flexible support structure that can adapt to new tools and platforms. Market forecasts suggest that the adoption of advanced technologies will lead to a 25% increase in demand for multi-vendor support services in the coming years. This growth reflects the need for organizations to stay competitive by leveraging the latest technological innovations.