Rising Demand for Smart Home Devices

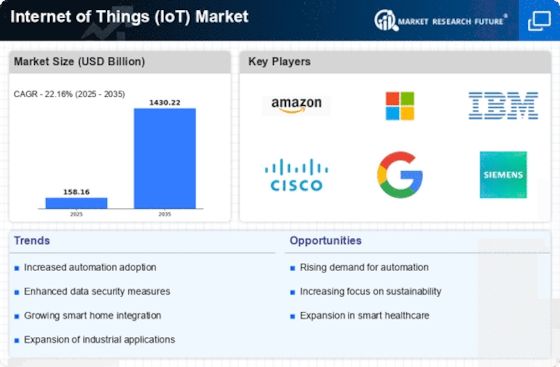

The Internet of Things Market (IoT) Market is experiencing a notable surge in demand for smart home devices. Consumers are increasingly seeking convenience, energy efficiency, and enhanced security through connected devices. According to recent data, the smart home segment is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is driven by advancements in technology, such as voice recognition and automation, which make these devices more user-friendly. As more households adopt smart appliances, the IoT ecosystem expands, creating opportunities for manufacturers and service providers. The integration of smart home devices into daily life not only enhances user experience but also contributes to energy savings, thereby appealing to environmentally conscious consumers. This trend indicates a robust future for the Internet of Things Market (IoT) Market.

Expansion of Industrial IoT Applications

The Internet of Things Market (IoT) Market is witnessing a significant expansion in industrial applications, often referred to as the Industrial Internet of Things Market (IIoT). Industries such as manufacturing, logistics, and energy are increasingly adopting IoT solutions to enhance operational efficiency and reduce costs. For instance, predictive maintenance powered by IoT sensors can lead to a reduction in downtime by up to 30%, thereby improving productivity. The IIoT market is expected to reach a valuation of over 100 billion dollars by 2026, driven by the need for real-time data analytics and automation. This shift towards smart factories and connected supply chains is indicative of a broader trend towards digital transformation across various sectors. As industries continue to embrace IoT technologies, the Internet of Things Market (IoT) Market is poised for substantial growth.

Advancements in Connectivity Technologies

The Internet of Things Market (IoT) Market is significantly influenced by advancements in connectivity technologies. The rollout of 5G networks is expected to revolutionize IoT applications by providing faster data transfer rates and lower latency. This enhanced connectivity enables a greater number of devices to communicate seamlessly, facilitating the development of more complex IoT ecosystems. As of October 2025, it is estimated that 5G will support up to 1 million devices per square kilometer, which could lead to unprecedented growth in IoT deployments across various sectors. Furthermore, the integration of technologies such as LPWAN (Low Power Wide Area Network) is enhancing the capabilities of IoT devices, particularly in remote monitoring and smart city applications. These advancements suggest a promising trajectory for the Internet of Things Market (IoT) Market.

Growing Focus on Data Analytics and Insights

The Internet of Things Market (IoT) Market is increasingly characterized by a growing focus on data analytics and insights. As IoT devices proliferate, they generate vast amounts of data that can be harnessed for actionable insights. Organizations are leveraging advanced analytics to improve decision-making processes, optimize operations, and enhance customer experiences. The global market for IoT analytics is projected to reach approximately 30 billion dollars by 2027, reflecting the rising importance of data-driven strategies. Companies are investing in analytics platforms that can process and analyze data in real-time, enabling them to respond swiftly to market changes. This trend underscores the critical role of data in shaping the future of the Internet of Things Market (IoT) Market.

Increased Regulatory Support for IoT Innovations

The Internet of Things Market (IoT) Market is benefiting from increased regulatory support aimed at fostering innovation and ensuring security. Governments are recognizing the potential of IoT technologies to drive economic growth and improve public services. As a result, various initiatives and frameworks are being established to promote the development and deployment of IoT solutions. For instance, regulations that encourage interoperability and standardization are likely to enhance market confidence and stimulate investment. Additionally, policies focused on data privacy and cybersecurity are becoming more prevalent, addressing consumer concerns and fostering trust in IoT applications. This supportive regulatory environment is expected to catalyze further advancements in the Internet of Things Market (IoT) Market.