Top Industry Leaders in the Multi-Vendor Support Services Market

Competitive Landscape of Multi-Vendor Support Services Market:

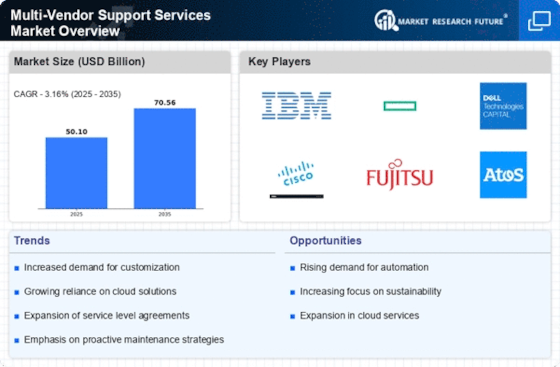

The multi-vendor support services (MVSS) market is experiencing a dynamic shift, driven by increasing IT complexity and the growing adoption of hybrid cloud environments. Businesses are no longer content with juggling separate support contracts for each vendor in their ecosystem. Instead, they seek the streamlined efficiency and cost-effectiveness of MVSS providers who can manage, troubleshoot, and optimize their diverse IT landscape under one roof.

This burgeoning demand has fueled intense competition within the MVSS market, with established players grappling against new entrants and niche specialists. To decipher this complex landscape, it's crucial to understand the key competitive strategies, market share determinants, and emerging trends:

Key Players:

- IBM

- HP

- Dell

- Microsoft

- Fujitsu

- NEC

- Hitachi

- Lenovo

- NetApp

- Abtech Technologies

Strategies Adopted by Key Players:

- Specialization vs. Generalization: Some players are carving out specific niches, focusing on expertise in particular industries (e.g., healthcare) or technology domains (e.g., cloud security). Others opt for a broader approach, catering to a wider range of client needs. The success of each strategy depends on market targeting and effective value proposition tailoring.

- Organic Growth vs. M&A: Established players prioritize internal expansion through training, certification, and service portfolio enhancements. Meanwhile, some companies are aggressively pursuing mergers and acquisitions to acquire new capabilities and access untapped markets.

- Partnerships and Alliances: Collaboration is key, with MVSS providers forging strategic partnerships with technology vendors, system integrators, and managed service providers (MSPs). These alliances not only broaden service offerings but also create a robust ecosystem benefiting both partners and clients.

- Technology Differentiation: Investing in automation, AI-powered analytics, and remote monitoring tools is becoming a critical differentiator. Such advanced solutions enable proactive issue identification, faster resolution times, and enhanced service delivery efficiency.

Market Share Determinants:

- Breadth and Depth of Service Portfolio: Clients seek comprehensive support covering hardware, software, networking, and cloud infrastructure. Providers with a diverse range of expertise and deep knowledge of specific technologies gain an edge.

- Global Reach and Scalability: The ability to deliver consistent, high-quality service across international locations is crucial for attracting multinational clients. Building a robust global network of skilled technicians and service centers is essential.

- Cost Competitiveness and Pricing Models: Balancing value with affordability is key. MVSS providers must offer flexible pricing models tailored to client needs, such as pay-per-use, fixed-fee, or tiered service levels.

- Customer Success Stories and Track Record: Proven experience in resolving complex IT issues and delivering measurable ROI strengthens reputation and trust within the market. Highlighting successful client case studies becomes a powerful marketing tool.

New and Emerging Companies:

The MVSS market is witnessing a surge of innovative startups capitalizing on specific technology trends:

- Cloud-Native MVSS Providers: These companies leverage their expertise in cloud platforms and offer specialized support for cloud-based deployments, catering to the fast-growing hybrid cloud segment.

- Security-Focused MVSS Providers: With cybersecurity a top concern, companies offering dedicated security monitoring, incident response, and vulnerability management services within their MVSS package are gaining traction.

- Data Analytics-Driven MVSS Providers: Utilizing advanced data analytics and machine learning, these players proactively identify potential issues and optimize IT performance, providing a more predictive and efficient approach to support.

Industry Developments

IBM:

- October 26, 2023: IBM acquired BlueRuth Consulting, a leading provider of multi-vendor IT support services, to strengthen its managed services portfolio and expand its reach in the mid-market.

- September 20, 2023: IBM launched a new multi-vendor support offering for edge computing, providing comprehensive support for connected devices and edge applications.

- July 12, 2023: IBM partnered with DXC Technology to offer joint multi-vendor support services, leveraging the combined expertise of both companies.

HP:

- December 15, 2023: HP announced the expansion of its Tech Pro Connect program, providing IT professionals with access to training and resources on multi-vendor support.

- November 10, 2023: HP partnered with Rimini Street to offer multi-vendor support for Oracle software, providing customers with an alternative to Oracle's own support services.

- September 8, 2023: HP launched a new AI-powered multi-vendor support platform that uses machine learning to automate troubleshooting and resolution of IT issues.