Cost-Effective Service Offerings

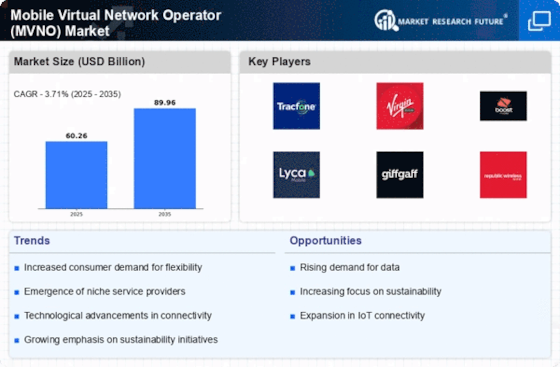

The Mobile Virtual Network Operator Market (MVNO) Market is characterized by its ability to provide cost-effective service offerings. MVNOs typically operate with lower overhead costs compared to traditional mobile network operators, allowing them to pass on savings to consumers. This competitive pricing strategy attracts price-sensitive customers, particularly in emerging markets where affordability is paramount. As of 2025, MVNOs are estimated to capture a significant share of the mobile subscriber base, with projections indicating that they could account for over 20% of total mobile subscriptions. This trend suggests that the MVNO model is increasingly appealing to consumers seeking budget-friendly alternatives without compromising on service quality.

Regulatory Support for MVNO Growth

The Mobile Virtual Network Operator Market (MVNO) Market benefits from increasing regulatory support aimed at fostering competition and innovation. Many governments are recognizing the value of MVNOs in enhancing consumer choice and driving down prices in the telecommunications sector. Regulatory frameworks that promote fair access to network infrastructure are enabling new entrants to compete effectively with established players. As of October 2025, it is anticipated that favorable regulatory conditions will contribute to a 20% increase in the number of MVNOs entering the market, thereby enriching the competitive landscape and providing consumers with more options.

Increased Demand for Flexible Plans

The Mobile Virtual Network Operator Market (MVNO) Market is witnessing a surge in demand for flexible mobile plans. Consumers are increasingly favoring customizable options that allow them to tailor their mobile services according to their specific needs. This shift is particularly evident among younger demographics who prioritize flexibility over long-term contracts. MVNOs are well-positioned to capitalize on this trend by offering a variety of plans that cater to different usage patterns, such as pay-as-you-go or data-only options. As of 2025, it is anticipated that flexible plans will drive a substantial portion of MVNO growth, potentially leading to a 15% increase in subscriber numbers within the next year.

Rising Consumer Preference for Digital Services

The Mobile Virtual Network Operator Market (MVNO) Market is increasingly shaped by the rising consumer preference for digital services. As more individuals rely on mobile devices for various aspects of their lives, including communication, entertainment, and commerce, the demand for integrated digital solutions is growing. MVNOs are responding by offering bundled services that combine mobile connectivity with digital content and applications. This trend is expected to enhance customer loyalty and retention, as consumers gravitate towards providers that offer comprehensive digital experiences. By 2025, it is estimated that MVNOs focusing on digital service integration could see a 12% increase in their customer base, reflecting the importance of adapting to consumer preferences.

Technological Advancements in Network Infrastructure

The Mobile Virtual Network Operator Market (MVNO) Market is significantly influenced by technological advancements in network infrastructure. The evolution of 5G technology and improvements in network virtualization are enabling MVNOs to offer enhanced services without the need for extensive physical infrastructure. This technological shift allows MVNOs to operate more efficiently and provide high-speed data services that meet the growing consumer demand for connectivity. As of October 2025, it is projected that MVNOs leveraging advanced network technologies will experience a growth rate of approximately 10% annually, indicating a robust future for those who adapt to these innovations.