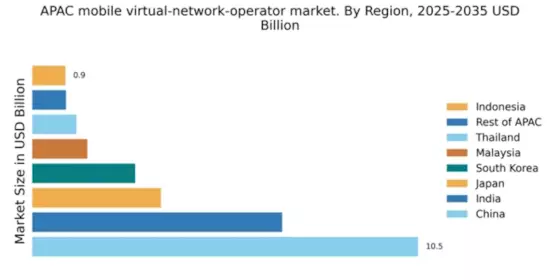

China : Unmatched Growth and Innovation

China holds a commanding 10.5% market share in the APAC mobile virtual-network-operator (MVNO) sector, driven by rapid urbanization and a tech-savvy population. The government's push for digital transformation and favorable regulatory policies have spurred demand for affordable mobile services. Infrastructure improvements, particularly in 5G rollout, have further enhanced connectivity, making mobile services more accessible to consumers across urban and rural areas.

India : Diverse Consumer Needs Drive Growth

India's MVNO market, with a 6.8% share, is characterized by a diverse consumer base seeking affordable mobile solutions. Key growth drivers include the increasing penetration of smartphones and the government's initiatives to promote digital literacy. Demand for data services is surging, particularly among younger demographics, while regulatory support encourages new entrants into the market, fostering competition and innovation.

Japan : High-Quality Services and Competition

Japan's MVNO market, holding a 3.5% share, is distinguished by its focus on high-quality services and advanced technology. The demand for mobile data continues to rise, driven by the popularity of mobile gaming and streaming services. Regulatory frameworks support MVNOs, allowing them to thrive alongside traditional carriers. The government is also investing in infrastructure to enhance connectivity and service quality across the nation.

South Korea : 5G Adoption Fuels Competition

South Korea's MVNO market, with a 2.8% share, is experiencing dynamic growth fueled by the rapid adoption of 5G technology. The competitive landscape is characterized by aggressive pricing strategies and innovative service offerings. Major cities like Seoul and Busan are key markets, where consumers demand high-speed data and flexible plans. Regulatory support for MVNOs is fostering a vibrant ecosystem, encouraging new entrants and enhancing service diversity.

Malaysia : Growing Demand for Affordable Plans

Malaysia's MVNO market, capturing a 1.5% share, is emerging as a competitive landscape driven by increasing demand for affordable mobile plans. The government's initiatives to enhance digital infrastructure and connectivity are pivotal in attracting new MVNOs. Urban areas like Kuala Lumpur are witnessing a surge in mobile data consumption, particularly among younger consumers who prioritize cost-effective solutions and flexible plans.

Thailand : Diverse Offerings for Consumers

Thailand's MVNO market, with a 1.2% share, is characterized by a competitive landscape offering diverse mobile plans tailored to various consumer needs. The growth is driven by increasing smartphone penetration and a young population eager for affordable data services. Regulatory policies are supportive, allowing MVNOs to flourish alongside established carriers. Key markets include Bangkok and Chiang Mai, where demand for mobile services is robust.

Indonesia : Untapped Potential in Telecom Market

Indonesia's MVNO market, holding a 0.9% share, presents significant growth potential driven by increasing mobile penetration and a young, tech-savvy population. The government is actively promoting digital initiatives to enhance connectivity across the archipelago. Key cities like Jakarta and Surabaya are witnessing rising demand for affordable mobile services, creating opportunities for new MVNO entrants to capture market share.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC, with a 0.92% market share, encompasses a diverse range of markets, each with unique challenges and opportunities. Growth is driven by varying consumer needs and regulatory environments. Countries in this category are witnessing gradual adoption of MVNO services, supported by government initiatives aimed at enhancing digital infrastructure. The competitive landscape is fragmented, with local players emerging to cater to specific market demands.