Increased Demand for Flexible Plans

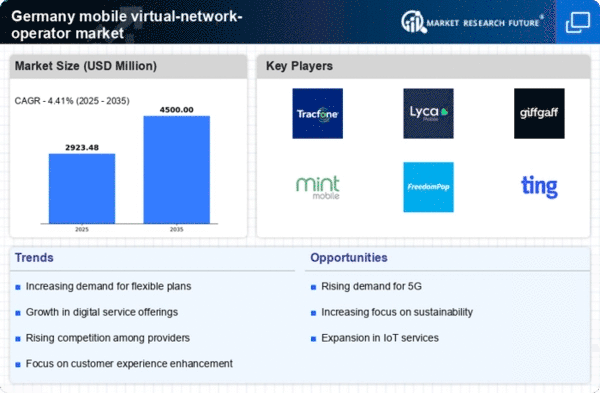

The mobile virtual-network-operator market in Germany experiences a notable surge in demand for flexible and customizable mobile plans. Consumers increasingly seek options that cater to their specific needs, such as pay-as-you-go or no-contract plans. This shift is driven by a growing awareness of cost-effectiveness and the desire for personalized services. According to recent data, approximately 30% of mobile users in Germany prefer flexible plans over traditional contracts. This trend indicates a significant opportunity for mobile virtual-network-operators to capture a larger market share by offering tailored solutions that resonate with consumer preferences.

Growing Adoption of Mobile Data Services

The mobile virtual-network-operator market in Germany is witnessing a significant increase in the adoption of mobile data services. With the proliferation of smartphones and mobile applications, consumers are increasingly reliant on data for various activities, including streaming, social media, and online shopping. Recent reports indicate that mobile data usage in Germany has surged by 25% in the last year alone. This trend suggests that mobile virtual-network-operators must adapt their offerings to meet the rising demand for data-centric plans, potentially leading to new revenue streams and enhanced customer loyalty.

Technological Integration and Innovation

Technological advancements play a crucial role in shaping the mobile virtual-network-operator market in Germany. The integration of advanced technologies, such as 5G and IoT, enables operators to offer enhanced services and improve operational efficiency. As 5G networks continue to roll out, mobile virtual-network-operators are likely to leverage this technology to provide faster and more reliable services. This shift could attract tech-savvy consumers who prioritize high-speed connectivity. Furthermore, the adoption of innovative solutions, such as eSIM technology, may streamline customer onboarding processes, thereby enhancing the overall user experience in the mobile virtual-network-operator market.

Regulatory Changes and Supportive Policies

The mobile virtual-network-operator market in Germany is influenced by regulatory changes and supportive government policies aimed at fostering competition and innovation. Recent initiatives by the German government to promote digital infrastructure development have created a favorable environment for mobile virtual-network-operators. These policies may include spectrum allocation and subsidies for network expansion, which can enhance service availability and quality. As a result, mobile virtual-network-operators are likely to benefit from reduced barriers to entry and increased access to resources, ultimately contributing to market growth and consumer satisfaction.

Rising Competition Among Service Providers

The competitive landscape of the mobile virtual-network-operator market in Germany intensifies as new entrants and established players vie for market share. This competition fosters innovation and drives down prices, benefiting consumers. Recent statistics reveal that the number of mobile virtual-network-operators in Germany has increased by 15% over the past year, leading to a wider array of service offerings. As operators strive to differentiate themselves, they are likely to invest in unique value propositions, enhancing customer experience and satisfaction. This dynamic environment presents both challenges and opportunities for existing players in the market.