Rising Mobile Data Consumption

The mobile virtual-network-operator market in Argentina experiences a notable surge in mobile data consumption. As smartphone penetration increases, users demand more data services, leading to a shift in consumer behavior. Reports indicate that mobile data traffic in Argentina is projected to grow by approximately 30% annually. This trend compels mobile virtual-network-operators to enhance their data offerings, ensuring competitive pricing and attractive packages. The growing reliance on mobile applications for communication, entertainment, and business further fuels this demand. Consequently, operators must adapt their strategies to cater to the evolving needs of consumers, positioning themselves effectively within the mobile virtual-network-operator market.

Cost-Effective Service Offerings

In Argentina, the mobile virtual-network-operator market thrives on the provision of cost-effective service offerings. With economic fluctuations, consumers increasingly seek affordable mobile plans that provide value without compromising quality. Mobile virtual-network-operators can leverage this demand by offering tailored packages that cater to specific demographics, such as students or low-income households. The competitive landscape encourages operators to innovate pricing strategies, potentially leading to a 15% reduction in average monthly costs for consumers. This focus on affordability not only attracts new customers but also fosters loyalty among existing users, thereby enhancing the overall market dynamics.

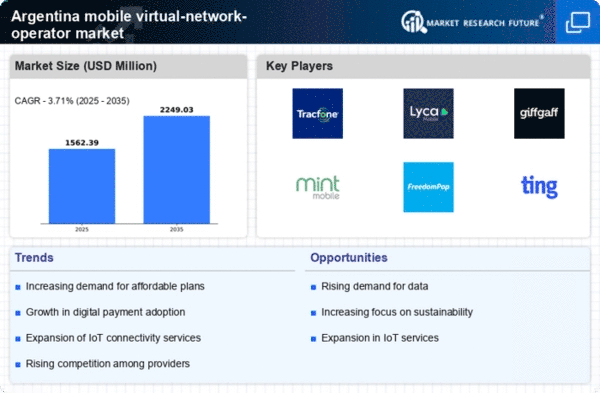

Increased Competition Among Providers

The mobile virtual-network-operator market in Argentina is characterized by heightened competition among providers. As new entrants emerge, existing operators are compelled to differentiate their services to maintain market share. This competitive environment stimulates innovation, prompting operators to enhance their service quality and customer experience. Market data suggests that the number of mobile virtual-network-operators in Argentina has increased by 20% over the past two years. This influx of competition may lead to improved service offerings, better pricing, and increased consumer choice, ultimately benefiting the mobile virtual-network-operator market as a whole.

Growing Demand for Customized Solutions

In Argentina, the mobile virtual-network-operator market witnesses a growing demand for customized solutions tailored to individual consumer needs. As users become more discerning, they seek personalized mobile plans that align with their usage patterns. This trend encourages operators to develop flexible offerings, such as pay-as-you-go plans or family bundles. Market analysis indicates that approximately 40% of consumers express interest in personalized services. By addressing this demand, mobile virtual-network-operators can enhance customer satisfaction and retention, thereby solidifying their position within the competitive landscape of the mobile virtual-network-operator market.

Technological Integration and Innovation

The mobile virtual-network-operator market in Argentina is significantly influenced by technological integration and innovation. Advancements in mobile technology, such as 5G deployment, create opportunities for operators to enhance their service capabilities. The introduction of 5G is expected to revolutionize the mobile experience, offering faster speeds and lower latency. As a result, mobile virtual-network-operators must invest in infrastructure and technology to remain competitive. Reports indicate that investments in network upgrades could reach $500 million over the next five years. This focus on technological advancement not only improves service quality but also positions operators favorably within the evolving mobile virtual-network-operator market.