Rising Mobile Data Consumption

The mobile virtual-network-operator market is significantly influenced by the rising consumption of mobile data in the GCC. As smartphone penetration continues to increase, consumers are utilizing mobile data for various applications, including streaming, social media, and online gaming. This trend is projected to drive a 25% increase in mobile data traffic by 2026. MVNOs are well-positioned to capitalize on this growth by offering data-centric plans that cater to the needs of consumers. The mobile virtual-network-operator market is thus likely to expand as it aligns its offerings with the increasing demand for mobile data services.

Regulatory Framework Enhancements

The regulatory environment in the GCC is evolving to support the growth of the mobile virtual-network-operator market. Governments are increasingly recognizing the importance of MVNOs in fostering competition and enhancing consumer choice. Recent regulatory changes have aimed at simplifying the licensing process for MVNOs, making it easier for new entrants to join the market. This supportive framework is expected to lead to an increase in the number of MVNOs operating in the region, thereby enriching the mobile virtual-network-operator market landscape. As competition intensifies, consumers are likely to benefit from improved services and pricing.

Cost-Effectiveness of MVNO Services

Cost considerations play a pivotal role in the growth of the mobile virtual-network-operator market. MVNOs typically operate with lower overhead costs than traditional mobile network operators, allowing them to offer competitive pricing. In the GCC, where consumers are increasingly price-sensitive, this cost-effectiveness becomes a significant driver. Reports indicate that MVNOs can provide services at rates that are 20-30% lower than those of established operators. This pricing advantage not only attracts budget-conscious consumers but also encourages businesses to consider MVNO partnerships for their communication needs, further expanding the market's reach.

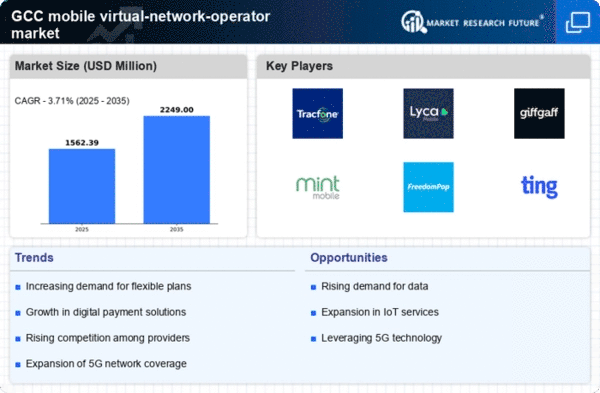

Increased Demand for Flexible Plans

The mobile virtual-network-operator market experiences a notable surge in demand for flexible and customizable mobile plans. Consumers in the GCC region increasingly seek tailored solutions that cater to their specific needs, such as data allowances and pricing structures. This trend is driven by a growing awareness of the benefits of MVNOs, which often provide competitive pricing compared to traditional operators. In 2025, MVNOs are projected to capture approximately 15% of the total mobile subscriber base in the GCC, indicating a shift towards more consumer-centric offerings. The mobile virtual-network-operator market is thus positioned to thrive as it adapts to these evolving consumer preferences.

Technological Integration and Innovation

The mobile virtual-network-operator market benefits from ongoing technological integration and innovation. Advancements in mobile technology, such as 5G deployment and IoT connectivity, create new opportunities for MVNOs to offer enhanced services. In the GCC, the rollout of 5G networks is expected to enhance the capabilities of MVNOs, allowing them to provide faster and more reliable services. This technological evolution is likely to attract a broader customer base, as consumers seek high-speed connectivity for various applications. The mobile virtual-network-operator market is thus positioned to leverage these innovations to enhance service offerings and customer satisfaction.