Advancements in Surgical Techniques

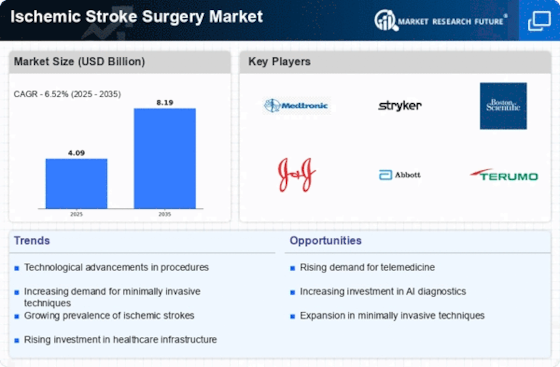

Innovations in surgical techniques are significantly influencing the Ischemic Stroke Surgery Market. The advent of minimally invasive procedures, such as endovascular thrombectomy, has revolutionized the treatment landscape for ischemic strokes. These techniques not only reduce recovery times but also minimize complications associated with traditional open surgeries. Data indicates that the use of endovascular procedures has increased by over 30% in recent years, reflecting a shift towards more efficient treatment options. As these advanced techniques become more widely adopted, they are likely to enhance patient outcomes and drive further growth in the Ischemic Stroke Surgery Market.

Rising Incidence of Ischemic Stroke

The increasing prevalence of ischemic stroke is a primary driver for the Ischemic Stroke Surgery Market. According to recent data, ischemic strokes account for approximately 87% of all stroke cases, leading to a heightened demand for surgical interventions. As the aging population continues to grow, the incidence of ischemic strokes is expected to rise, thereby necessitating more surgical procedures. This trend is further exacerbated by lifestyle factors such as obesity, hypertension, and diabetes, which are prevalent in many populations. Consequently, healthcare systems are compelled to enhance their surgical capabilities to address this growing health crisis, thereby propelling the Ischemic Stroke Surgery Market forward.

Growing Awareness of Stroke Symptoms

The rising awareness of stroke symptoms among the general population is positively impacting the Ischemic Stroke Surgery Market. Educational campaigns aimed at informing individuals about the signs of ischemic stroke have led to earlier recognition and treatment. This increased awareness is crucial, as timely intervention can significantly improve surgical outcomes. Data suggests that regions with robust public health campaigns have seen a 20% increase in patients seeking immediate care for stroke symptoms. As more individuals become educated about the importance of rapid response to stroke symptoms, the demand for surgical interventions is likely to rise, further driving the Ischemic Stroke Surgery Market.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is a pivotal driver for the Ischemic Stroke Surgery Market. Technologies such as artificial intelligence and telemedicine are being increasingly utilized to enhance surgical planning and patient management. AI algorithms can assist in predicting stroke risks and optimizing surgical approaches, while telemedicine facilitates remote consultations and follow-ups. This technological evolution not only improves patient outcomes but also streamlines surgical processes, making them more efficient. As healthcare providers continue to adopt these technologies, the Ischemic Stroke Surgery Market is expected to experience substantial growth, driven by improved surgical precision and patient care.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a crucial factor propelling the Ischemic Stroke Surgery Market. Governments and private entities are increasingly allocating funds to improve healthcare facilities, particularly in regions with high stroke incidence. This investment often includes the acquisition of advanced surgical equipment and training for healthcare professionals, which enhances the overall quality of care. For instance, many countries are establishing specialized stroke centers equipped with state-of-the-art technology to facilitate timely interventions. As healthcare infrastructure continues to improve, the capacity to perform ischemic stroke surgeries is expected to expand, thereby stimulating growth in the Ischemic Stroke Surgery Market.