Ischemic Stroke Surgery Size

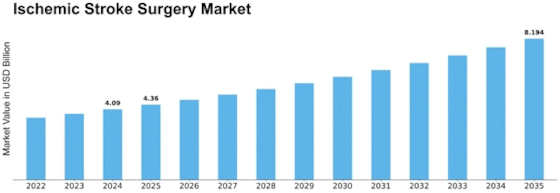

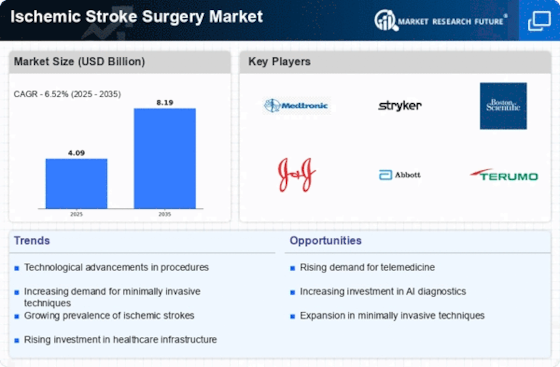

Ischemic Stroke Surgery Market Growth Projections and Opportunities

The expansion of the ischemic stroke surgery market is linked to the increase in physical inactivity and sedentary lifestyles, along with the adoption and introduction of technologically advanced products, and a growing preference for minimally invasive procedures. Nevertheless, the limited availability of medical facilities in developing nations and a shortage of skilled professionals are expected to pose challenges to the market's growth.

The surge in the ischemic stroke surgery market is influenced by several factors that play a crucial role in shaping its trajectory. One significant contributor is the escalation in physical inactivity and the prevalence of sedentary lifestyles. As more individuals engage in sedentary behaviors and lead less active lives, the risk of ischemic stroke increases. This heightened risk propels the demand for medical interventions and surgical procedures to address ischemic strokes, thus fostering the growth of the market.

Another driving force behind the market's expansion is the adoption and introduction of technologically advanced products. As medical technology continues to evolve, new and improved surgical tools, equipment, and procedures are developed to enhance the effectiveness of ischemic stroke surgery. The integration of cutting-edge technologies not only improves the outcomes of surgical interventions but also attracts healthcare providers and patients seeking state-of-the-art solutions.

The rising demand for minimally invasive procedures represents a significant growth factor for the ischemic stroke surgery market. Minimally invasive techniques offer several advantages, including reduced recovery times, lower risk of complications, and smaller incisions. Patients and healthcare professionals alike are increasingly opting for these procedures, contributing to the overall expansion of the ischemic stroke surgery market.

However, despite the positive growth indicators, certain challenges are anticipated to impede the market's progress. A notable hindrance is the lack of adequate medical facilities in developing countries. In many regions with limited healthcare infrastructure, access to specialized ischemic stroke surgery services may be restricted. This geographical disparity poses a challenge to the widespread adoption of ischemic stroke surgical interventions.

Additionally, a shortage of skilled professionals in the field of ischemic stroke surgery is identified as a potential obstacle to market growth. Surgical procedures, especially those involving critical areas such as the brain, require highly trained and experienced medical professionals. The shortage of skilled surgeons and healthcare staff may limit the availability and accessibility of ischemic stroke surgery services, particularly in regions facing workforce challenges.

The growth of the ischemic stroke surgery market is fueled by various factors such as the increasing prevalence of sedentary lifestyles, advancements in medical technology, and the growing preference for minimally invasive procedures. These factors contribute to the demand for effective surgical interventions to address ischemic strokes. However, challenges like the limited availability of medical facilities in developing countries and a shortage of skilled professionals pose potential hurdles to the market's overall expansion. As the healthcare landscape continues to evolve, addressing these challenges will be crucial to ensuring widespread access to high-quality ischemic stroke surgery services globally.

Leave a Comment