Rising Geriatric Population

The demographic shift towards an aging population in India is a significant driver for the ischemic stroke-surgery market. As the elderly population continues to grow, the prevalence of ischemic strokes is likely to increase, necessitating surgical interventions. Reports indicate that individuals aged 65 and above are at a higher risk of stroke, with the geriatric population expected to reach 300 million by 2030. This demographic trend underscores the need for specialized surgical care tailored to older patients. Additionally, the increasing awareness of stroke symptoms and the importance of timely treatment among the elderly may lead to higher demand for surgical procedures. Consequently, the ischemic stroke-surgery market is anticipated to expand in response to the needs of this vulnerable population.

Growing Healthcare Infrastructure

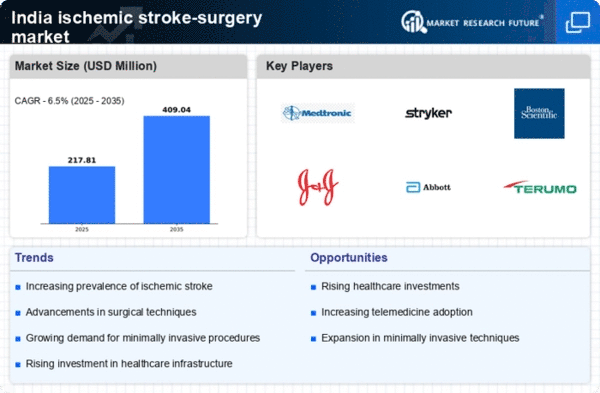

The expansion of healthcare infrastructure in India plays a pivotal role in the growth of the ischemic stroke-surgery market. With increasing investments in healthcare facilities, the number of specialized stroke centers is on the rise. Government initiatives aimed at enhancing healthcare access, particularly in rural areas, are likely to improve patient outcomes. The establishment of comprehensive stroke units and advanced neuro-interventional centers is expected to facilitate timely surgical interventions. Furthermore, the healthcare expenditure in India is projected to reach approximately $370 billion by 2025, indicating a robust investment in medical services. This growth in infrastructure not only supports the ischemic stroke-surgery market but also enhances the overall quality of care for stroke patients.

Advancements in Medical Technology

Technological innovations in medical devices and surgical techniques are transforming the ischemic stroke-surgery market. The introduction of minimally invasive procedures, robotic-assisted surgeries, and advanced imaging technologies enhances surgical precision and patient recovery times. For instance, the use of stent retrievers and thrombectomy devices has shown promising results in improving patient outcomes. The market for these advanced devices is projected to grow at a CAGR of around 10% over the next few years. Additionally, the integration of artificial intelligence in surgical planning and execution is expected to further revolutionize the field. As hospitals and surgical centers adopt these cutting-edge technologies, the ischemic stroke-surgery market is poised for substantial growth, driven by the demand for improved surgical efficacy and patient safety.

Increasing Incidence of Ischemic Stroke

The rising incidence of ischemic stroke in India is a critical driver for the ischemic stroke-surgery market. According to recent health statistics, ischemic strokes account for approximately 87% of all strokes, with a notable increase in cases attributed to lifestyle changes and an aging population. This trend necessitates advanced surgical interventions, thereby propelling market growth. The demand for effective surgical solutions is expected to rise as more individuals seek treatment options. Furthermore, the economic burden associated with stroke care, estimated to reach billions of dollars annually, underscores the urgency for innovative surgical techniques. As healthcare providers aim to improve patient outcomes, the ischemic stroke-surgery market is likely to expand significantly in response to this growing health crisis.

Enhanced Patient Awareness and Education

The growing awareness and education regarding stroke symptoms and treatment options are driving the ischemic stroke-surgery market. Public health campaigns and educational initiatives by healthcare organizations have significantly improved knowledge about the importance of early intervention. As more individuals recognize the signs of ischemic stroke, there is a greater likelihood of seeking timely medical attention, which can lead to increased surgical procedures. Furthermore, the emphasis on preventive measures and lifestyle modifications is likely to influence patient behavior positively. The market is expected to benefit from this heightened awareness, as patients become more proactive in managing their health. Overall, the focus on education and awareness is a crucial factor contributing to the growth of the ischemic stroke-surgery market.