Market Share

Ischemic Stroke Surgery Market Share Analysis

The Ischemic Stroke Surgery Market presents a myriad of opportunities for growth and innovation as advancements in medical technology and research continue to unfold. This dynamic and rapidly evolving sector holds promise for various stakeholders, including healthcare providers, medical device manufacturers, pharmaceutical companies, and investors. Here are 800 simple words highlighting the opportunities in the Ischemic Stroke Surgery Market:

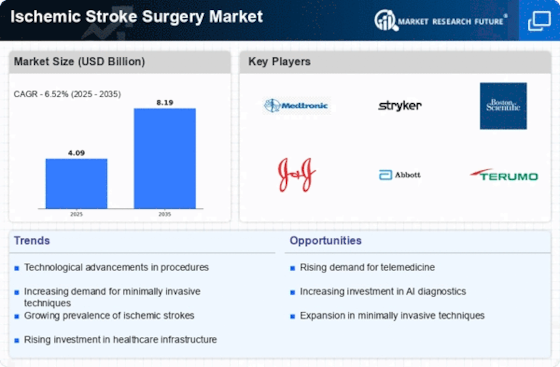

Introduction: The Ischemic Stroke Surgery Market is witnessing a surge in opportunities driven by a combination of technological advancements, increasing prevalence of ischemic strokes, and a growing aging population. Ischemic strokes account for a significant portion of all stroke cases, making it a focal point for healthcare interventions and innovations. As the global healthcare landscape continues to prioritize stroke management, the market for Ischemic Stroke Surgery is poised for substantial growth.

Technological Advancements: One of the primary drivers of opportunities in the Ischemic Stroke Surgery Market is the continuous evolution of surgical technologies. Minimally invasive procedures, robotic-assisted surgeries, and advanced imaging techniques are transforming the landscape of ischemic stroke interventions. These innovations not only enhance the precision of surgeries but also contribute to reduced recovery times and improved patient outcomes. Medical device manufacturers have a ripe opportunity to invest in research and development to create cutting-edge tools that can further streamline ischemic stroke surgeries.

Telemedicine and Remote Monitoring: The integration of telemedicine and remote monitoring in ischemic stroke care presents another avenue of opportunity. With the advent of digital health solutions, healthcare providers can remotely monitor post-surgery recovery, track patient progress, and intervene promptly in case of complications. This not only enhances patient care but also reduces the burden on healthcare facilities, opening doors for companies specializing in telehealth solutions to contribute to the Ischemic Stroke Surgery Market.

Personalized Medicine: The move towards personalized medicine is gaining momentum in the Ischemic Stroke Surgery Market. Tailoring treatment plans based on individual patient characteristics, genetics, and other factors can significantly improve the efficacy of interventions. Pharmaceutical companies have the opportunity to explore and develop targeted therapies that address specific aspects of ischemic strokes, potentially revolutionizing treatment approaches and outcomes.

Global Collaborations and Partnerships: Global collaborations and partnerships offer a promising avenue for growth in the Ischemic Stroke Surgery Market. Collaborations between healthcare institutions, research organizations, and industry players can facilitate knowledge exchange, joint research initiatives, and the development of innovative solutions. This collaborative approach fosters a synergistic environment where collective efforts can address the complex challenges associated with ischemic stroke surgery.

Preventive Interventions: Opportunities also lie in the development of preventive interventions for ischemic strokes. Identifying individuals at high risk and implementing preemptive measures can significantly reduce the incidence of strokes. This opens the door for pharmaceutical companies and researchers to explore novel medications, lifestyle interventions, and other preventive strategies that can contribute to a holistic approach in managing ischemic stroke risk.

Patient Education and Awareness: An often-overlooked opportunity in the Ischemic Stroke Surgery Market is patient education and awareness. Empowering individuals with knowledge about risk factors, symptoms, and preventive measures can lead to early detection and intervention. Companies specializing in healthcare communication, digital marketing, and educational materials have the chance to play a vital role in enhancing public awareness about ischemic strokes and available surgical interventions.

Investment Opportunities: Investors keen on the healthcare sector can find lucrative opportunities in the Ischemic Stroke Surgery Market. As the demand for advanced surgical interventions rises, funding innovative startups, supporting research endeavors, and investing in established companies within the ischemic stroke space can yield substantial returns. The market's dynamic nature and potential for groundbreaking discoveries make it an attractive proposition for investors seeking growth opportunities.

Conclusion: The Ischemic Stroke Surgery Market presents a landscape rich with opportunities for those involved in healthcare, technology, and research. The convergence of technological advancements, personalized medicine, and a global collaborative approach creates a fertile ground for transformative developments in ischemic stroke interventions. Embracing these opportunities not only holds the potential for economic growth but, more importantly, contributes to advancing the quality of care for individuals at risk of or affected by ischemic strokes.

Leave a Comment