Technological Advancements in Robotics

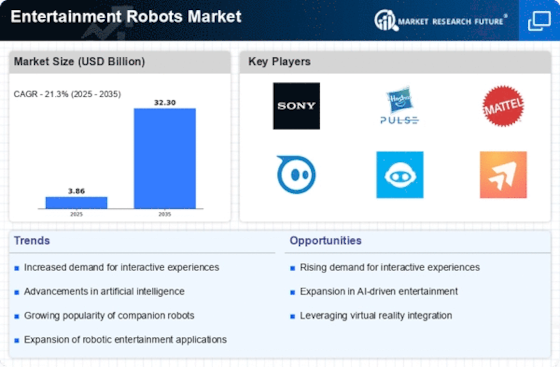

The Entertainment Robots Market is experiencing a surge in technological advancements, particularly in robotics and artificial intelligence. Innovations in machine learning and sensor technology are enabling robots to interact more naturally with users, enhancing the overall entertainment experience. For instance, the integration of advanced AI algorithms allows robots to learn from user interactions, adapting their behavior to meet individual preferences. This trend is reflected in the increasing investment in research and development, with the market projected to reach USD 15 billion by 2026. As technology continues to evolve, the capabilities of entertainment robots are expected to expand, attracting a broader audience and driving market growth.

Growing Demand for Interactive Experiences

The Entertainment Robots Market is witnessing a growing demand for interactive experiences among consumers. As audiences seek more engaging and immersive forms of entertainment, robots that can provide personalized interactions are becoming increasingly popular. This trend is particularly evident in sectors such as gaming and theme parks, where robots are utilized to create unique experiences that captivate users. Market data indicates that the demand for interactive entertainment solutions is expected to grow at a compound annual growth rate of 12% over the next five years. This shift towards interactive experiences is likely to propel the entertainment robots market forward, as companies strive to meet consumer expectations.

Expansion of Robotics in Entertainment Venues

The Entertainment Robots Market is experiencing an expansion of robotics in various entertainment venues, including theaters, amusement parks, and museums. This trend is driven by the desire to enhance visitor experiences and create memorable interactions. For example, robots are increasingly being used for performances, guiding visitors, and providing information in a more engaging manner. Market analysis shows that the integration of robots in entertainment venues has led to a 20% increase in visitor satisfaction ratings. As more venues adopt robotic solutions, the entertainment robots market is expected to grow, driven by the need for innovative attractions that differentiate them from competitors.

Increased Investment in Entertainment Robotics

The Entertainment Robots Market is benefiting from increased investment from both private and public sectors. Venture capital firms and technology companies are recognizing the potential of entertainment robots, leading to a surge in funding for startups and established firms alike. This influx of capital is facilitating the development of innovative products and services, which in turn is driving market expansion. Recent reports suggest that investment in entertainment robotics has doubled in the past three years, indicating a strong belief in the future growth of this sector. As more resources are allocated to research and development, the market is likely to see a proliferation of new and exciting entertainment robots.

Rising Popularity of Home Entertainment Robots

The Entertainment Robots Market is witnessing a rising popularity of home entertainment robots, particularly in the context of family-oriented products. As households seek new forms of entertainment, robots designed for home use are becoming increasingly appealing. These robots often combine educational features with entertainment, making them attractive to parents looking for engaging activities for their children. Market data suggests that the segment of home entertainment robots is projected to grow by 15% annually, reflecting a shift in consumer preferences towards interactive and educational experiences at home. This trend is likely to drive further innovation and investment in the entertainment robots market.