Top Industry Leaders in the Electric Vehicles Battery Market

*Disclaimer: List of key companies in no particular order

The Electric Vehicle Battery Market's Competitive Landscape

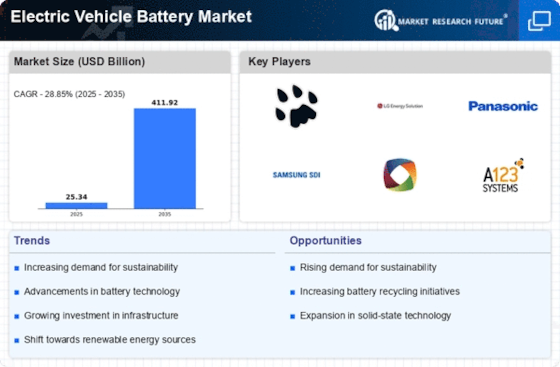

The electric vehicle (EV) battery market is witnessing robust growth, propelled by the rising adoption of EVs and global governments' ambitious sustainability targets. This dynamic sector is marked by intense competition among established entities and the emergence of new players, all striving for a larger market share.

Key Market Players:1. Automotive Energy Supply Corporation (Japan)2. Panasonic Corporation (Japan)3. BYD Company Limited (China)4. Quallion (US)5. LG Chem Ltd (South Korea)6. Boston-Power (US)7. Johnson Controls International (US)8. Narada Power Source (China)9. GS Yuasa Corporation (Japan)10. Crown Battery Corporation (US)11. Tianneng Power International (China)12. Hitachi Chemical Company (Japan)

Dominant Players in Asia: CATL (China), BYD (China), LG Chem (South Korea), SK Innovation (South Korea), Panasonic (Japan) dominate the market due to established production facilities, economies of scale, and strong relationships with leading EV manufacturers.

Western Challengers: Tesla (USA), Volkswagen Group (Germany), Stellantis (Italy/France), General Motors (USA), Ford (USA) are actively investing in battery production and technology development to solidify their market positions.

Emerging Players: Northvolt (Sweden), Redwood Materials (USA), Britishvolt (UK) are disrupting the market with innovative technologies and unique business models, emphasizing sustainable practices and closed-loop recycling.

Adopted Strategies:1. Vertical Integration: Leading EV manufacturers like Tesla and Volkswagen are integrating their supply chains, acquiring battery producers, or establishing internal production to gain control over costs and technology.2. Strategic Partnerships: Collaboration agreements between battery manufacturers and automakers are common, leveraging strengths to accelerate product development and market penetration.3. Technological Innovation: Continuous research and development focus on improving energy density, fast charging capabilities, and reducing costs.4. Geographic Expansion: Established players are expanding production globally, especially in regions with high EV adoption and favorable government policies.

Factors for Market Share Analysis:1. Production Capacity: Meeting growing demand is crucial for market share dominance.2. Technology Leadership: Companies focusing on advanced battery technology gain a competitive edge.3. Cost Competitiveness: Optimizing production and securing competitive raw material access is vital.4. Brand Reputation: Established players with reliability and strong brand recognition have advantages.5. Government Policies: Incentives and regulations significantly influence market growth and the competitive landscape.

New Entrants:Companies like Northvolt, Redwood Materials, and Britishvolt challenge the status quo with sustainable technologies and business models, emphasizing:1. Sustainable Materials: Utilizing recycled materials and designing batteries for easy disassembly and recycling.2. Closed-Loop Recycling: Establishing facilities for recapturing valuable materials from used batteries.3. Second-Life Applications: Repurposing used EV batteries for stationary energy storage applications.

Overall Competitive Scenario:The EV battery market anticipates ongoing intense competition, driven by technological advancements and increasing demand for sustainable mobility solutions. Established players leverage scale and experience, while new entrants disrupt with innovative technologies and sustainable practices. Collaboration and strategic partnerships are critical for success.

Future Outlook:The future of the EV battery market looks promising, with significant growth expected. Success hinges on adaptability to market trends, embracing innovation, and building strong relationships across the EV ecosystem.

Industry Developments and Updates:• Automotive Energy Supply Corporation (October 26, 2023) announced a partnership with a major mining company for a long-term supply of critical minerals for EV battery production.• Panasonic Corporation (October 26, 2023) unveiled a new generation of EV batteries with increased energy density and faster charging times.• Quallion (October 18, 2023) secured a $100 million investment from a major energy company to support its development of next-generation solid-state EV batteries.• LG Chem Ltd (October 18, 2023) reported a 25% increase in its EV battery sales in the third quarter of 2023.• Boston-Power (October 18, 2023) announced a partnership with a leading automotive manufacturer to supply EV batteries for its new electric vehicle models.