Rising Fuel Prices

The Plug-In Hybrid Electric Vehicles Market PHEV Market is also propelled by the rising fuel prices that consumers face. As traditional fuel costs continue to escalate, consumers are increasingly seeking alternative transportation options that offer cost savings. PHEVs, which can operate on both electricity and gasoline, provide a viable solution for those looking to mitigate fuel expenses. In 2025, the average price of gasoline has seen a notable increase, prompting consumers to consider PHEVs as a more economical choice. This shift in consumer behavior is likely to bolster the demand for PHEVs, further stimulating market growth.

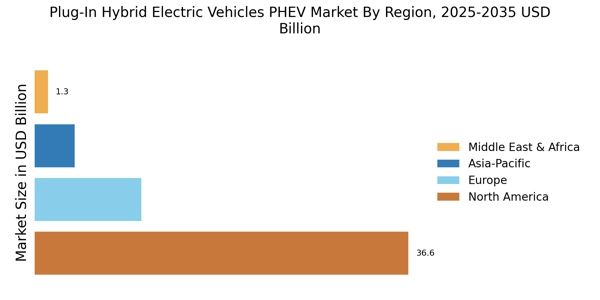

Expansion of Urban Mobility Solutions

The expansion of urban mobility solutions is increasingly impacting the Plug-In Hybrid Electric Vehicles Market PHEV Market. As cities strive to reduce congestion and pollution, PHEVs are being integrated into various urban transportation initiatives. In 2025, many urban areas are implementing policies that promote the use of PHEVs in public transportation and shared mobility services. This integration not only enhances the visibility of PHEVs but also encourages consumers to consider them as viable options for personal use. The synergy between urban mobility solutions and PHEVs is likely to drive market growth and adoption.

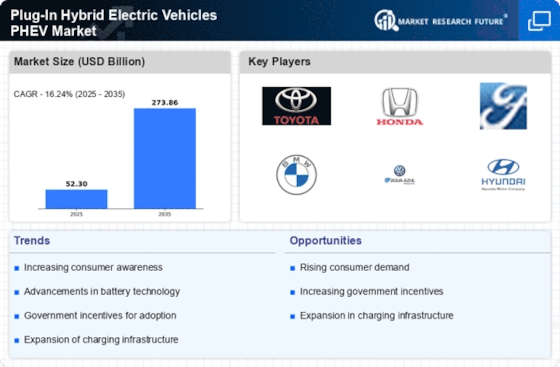

Government Incentives and Regulations

The Plug-In Hybrid Electric Vehicles Market PHEV Market is significantly influenced by government incentives and regulations aimed at promoting cleaner transportation. Various countries have implemented tax credits, rebates, and grants to encourage consumers to purchase PHEVs. For instance, in 2025, several regions offer incentives that can reduce the purchase price of PHEVs by thousands of dollars. Additionally, stringent emissions regulations compel manufacturers to innovate and produce more environmentally friendly vehicles. This regulatory landscape not only fosters consumer adoption but also drives manufacturers to invest in PHEV technology, thereby enhancing the overall market growth.

Environmental Concerns and Sustainability

The growing awareness of environmental issues plays a crucial role in shaping the Plug-In Hybrid Electric Vehicles Market PHEV Market. Consumers are becoming more conscious of their carbon footprints and are actively seeking sustainable transportation options. PHEVs, which emit fewer greenhouse gases compared to traditional vehicles, align with the values of eco-conscious consumers. In 2025, a significant percentage of consumers express a preference for vehicles that contribute to environmental sustainability. This trend not only drives demand for PHEVs but also encourages manufacturers to enhance their offerings, thereby fostering innovation within the market.

Technological Innovations in Electric Powertrains

Technological advancements in electric powertrains are a key driver of the Plug-In Hybrid Electric Vehicles Market PHEV Market. Innovations in battery technology, such as increased energy density and faster charging capabilities, enhance the performance and appeal of PHEVs. In 2025, many PHEVs are equipped with advanced electric powertrains that offer longer electric-only ranges and improved efficiency. These technological improvements not only attract consumers but also enable manufacturers to differentiate their products in a competitive market. As technology continues to evolve, it is likely to further stimulate growth in the PHEV sector.