Adoption of Flexible Work Models

The Digital Workplace Market is increasingly shaped by the adoption of flexible work models, which allow employees to choose their work environment. This shift is driven by the recognition that flexibility can enhance employee satisfaction and productivity. Data indicates that organizations implementing flexible work arrangements have reported a 20% increase in employee engagement. As companies strive to attract and retain top talent, the demand for solutions that support flexible work arrangements is expected to rise. This trend not only transforms traditional workplace dynamics but also influences the tools and technologies that are developed within the Digital Workplace Market, fostering innovation and adaptability.

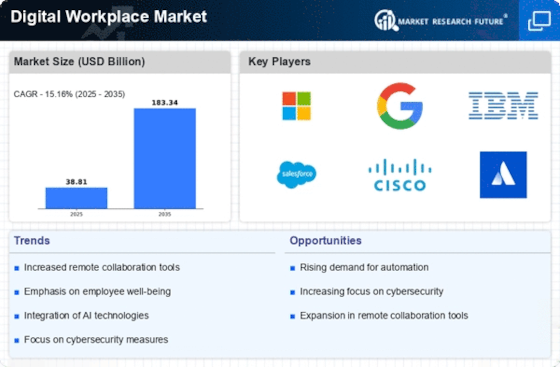

Emphasis on Cybersecurity Measures

In the Digital Workplace Market, the emphasis on cybersecurity measures has intensified as organizations recognize the importance of protecting sensitive data. With the rise of remote work, the potential for cyber threats has escalated, prompting companies to invest heavily in robust security protocols. Recent statistics suggest that cybersecurity spending in the workplace has surged by over 25% in the past year, reflecting a proactive approach to safeguarding digital assets. This trend indicates that organizations are not only focusing on operational efficiency but also on creating a secure digital environment for their employees. As the Digital Workplace Market evolves, the integration of advanced cybersecurity solutions will likely become a critical driver of growth.

Rise of Data-Driven Decision Making

The Digital Workplace Market is increasingly influenced by the rise of data-driven decision making, as organizations leverage analytics to inform their strategies. The ability to collect and analyze data allows companies to make informed choices that enhance operational efficiency and drive growth. Recent findings suggest that organizations utilizing data analytics have experienced a 30% improvement in decision-making speed. This trend underscores the importance of integrating data analytics tools within the digital workplace, as they enable organizations to respond swiftly to market changes. As the Digital Workplace Market continues to evolve, the emphasis on data-driven approaches will likely remain a key driver of innovation and competitiveness.

Integration of Advanced Collaboration Tools

The Digital Workplace Market is witnessing a notable shift towards advanced collaboration tools that enhance communication and teamwork among employees. These tools, which include video conferencing, instant messaging, and project management software, are becoming essential for organizations aiming to improve productivity. According to recent data, the adoption of collaboration tools has increased by approximately 30% in the last year, indicating a strong trend towards remote and hybrid work environments. This integration not only streamlines workflows but also fosters a culture of collaboration, which is crucial in today's competitive landscape. As organizations continue to prioritize effective communication, the demand for innovative collaboration solutions within the Digital Workplace Market is expected to grow significantly.

Growing Demand for Employee Training and Development

In the Digital Workplace Market, there is a growing demand for employee training and development programs that equip workers with the necessary skills to thrive in a digital environment. As technology evolves, organizations are recognizing the need to invest in continuous learning to keep their workforce competitive. Recent surveys indicate that companies allocating resources to employee development have seen a 15% increase in overall productivity. This focus on training not only enhances individual performance but also contributes to a more skilled and adaptable workforce. Consequently, the Digital Workplace Market is likely to see an increase in platforms and solutions designed to facilitate ongoing education and professional growth.