Investment in Cybersecurity Solutions

As organizations in the GCC increasingly adopt digital workplace solutions, the need for robust cybersecurity measures becomes paramount. The digital workplace market is witnessing a surge in investments aimed at safeguarding sensitive data and ensuring compliance with regulatory standards. Recent statistics indicate that cybersecurity spending in the region is projected to reach $30 billion by 2026, reflecting a growing awareness of potential threats. Companies are prioritizing the implementation of advanced security protocols, including encryption, multi-factor authentication, and employee training programs. This focus on cybersecurity not only protects organizational assets but also builds trust among clients and stakeholders. Consequently, the digital workplace market is evolving to incorporate security features as a fundamental aspect of its offerings, ensuring that businesses can operate safely in an increasingly digital landscape.

Integration of Collaborative Technologies

The integration of collaborative technologies is a key driver in the digital workplace market, particularly within the GCC. Organizations are increasingly adopting tools that facilitate real-time communication and collaboration among employees, regardless of their physical location. This trend is supported by the growing recognition of the importance of teamwork in achieving business objectives. Data suggests that companies utilizing collaborative technologies experience a 25% increase in productivity. As a result, the digital workplace market is evolving to include a wide range of collaborative tools, such as video conferencing, project management software, and instant messaging platforms. This integration not only enhances communication but also fosters a culture of collaboration, which is essential for driving innovation and achieving organizational success.

Advancements in Cloud Computing Technologies

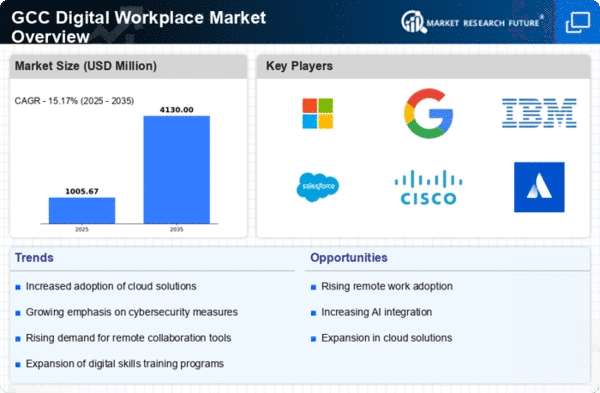

The digital workplace market is significantly influenced by advancements in cloud computing technologies, which enable organizations in the GCC to enhance their operational efficiency. The shift towards cloud-based solutions allows for seamless access to applications and data from any location, fostering collaboration among teams. Recent reports suggest that the cloud services market in the GCC is expected to grow at a CAGR of 20% over the next five years. This growth is attributed to the increasing adoption of Software as a Service (SaaS) and Infrastructure as a Service (IaaS) models, which provide scalable and cost-effective solutions for businesses. As organizations continue to migrate to the cloud, the digital workplace market is likely to expand, offering innovative tools that support remote work and improve overall productivity.

Emphasis on Employee Training and Development

In the context of the digital workplace market, there is a growing emphasis on employee training and development initiatives within organizations in the GCC. Companies recognize that investing in their workforce is essential for maximizing the potential of digital tools and technologies. Recent surveys indicate that approximately 60% of organizations in the region are increasing their budgets for employee training programs. This focus on skill enhancement not only improves employee engagement but also ensures that teams are equipped to leverage digital workplace solutions effectively. As a result, the digital workplace market is likely to see a rise in demand for training platforms and resources that facilitate continuous learning and development, ultimately contributing to a more skilled and adaptable workforce.

Growing Demand for Flexible Work Arrangements

The digital workplace market is experiencing a notable shift towards flexible work arrangements, driven by the evolving expectations of the workforce in the GCC. Employees increasingly seek the ability to work remotely or in hybrid models, which has led organizations to adopt digital solutions that facilitate this flexibility. According to recent data, approximately 70% of employees in the GCC express a preference for flexible work options. This trend compels companies to invest in digital workplace technologies that support remote collaboration, communication, and project management. As a result, the digital workplace market is likely to expand, with businesses prioritizing tools that enhance productivity and employee satisfaction. The emphasis on flexibility not only improves work-life balance but also attracts top talent, thereby fostering a more competitive environment within the digital workplace market.