Top Industry Leaders in the Digital Workplace Market

Competitive Landscape of Digital Workplace Market

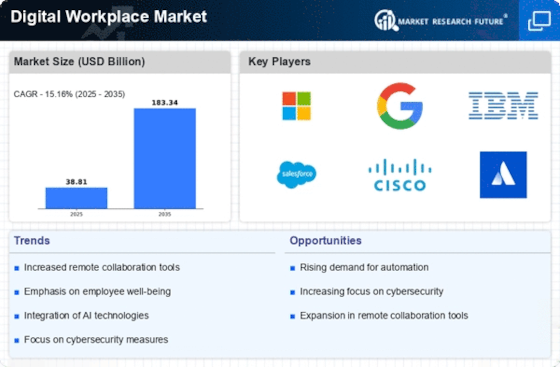

The digital workplace market, encompassing technologies and services that empower a flexible, connected, and productive workforce, is in the midst of a transformative boom. Fueled by the pandemic-driven shift towards remote work and the relentless pace of technological innovation. Within this dynamic landscape, a diverse roster of key players jostle for market share, employing a range of strategies to attract and retain clients.

Key Players:

- International Business Machines Corporation

- Zensar Technologies

- Wipro Limited

- HCL Technologies

- Atos

- Capgemini SE

- Cognizant Technology Solutions Corporation

- NTT Data Corporation

- Infosys Limited

- DXC Technology

- Accenture plc

- Fujitsu Limited

- Unisys Corporation

- The Hewlett Packard Enterprise Company

- Tata Consultancy Services

- CompuCom Systems Inc.

- Tandem

- Unmind

- Zoho Corporation

- Torii

Challengers Arise: Niche Specialists and Cloud Upstarts

However, the digital workplace market is not a one-horse race. A slew of niche specialists are carving out impressive niches. Slack, with its focus on team communication, and Zoom, synonymous with video conferencing, have become critical components of many digital workplaces. Meanwhile, cloud-based companies like Atlassian, Box, and Dropbox offer agile solutions for project management, content management, and file sharing, respectively. These niche players excel by offering exceptional functionality in their specific areas, often at competitive price points.

The Rise of the Integrators: Taming the Tech Sprawl

The proliferation of solutions, however, raises a challenge: tech sprawl. Organizations are struggling to integrate and manage a growing patchwork of digital workplace tools. This has opened doors for integration specialists like Okta and Ping Identity, offering identity and access management solutions that unify disparate platforms and streamline workflows. Similarly, companies like ServiceNow and Ivanti are driving adoption of digital experience platforms (DXPs) that provide a single, unified interface for employees to access all their work tools and information.

Beyond Tools: Embracing the Human Angle

The evolving digital workplace is not just about tools; it's about redefining how people work. Companies like Culture Amp and BambooHR are pioneering software that fosters employee engagement, performance management, and talent development. Mental health and well-being are also gaining traction, with companies like Headspace and Calm offering mindfulness and meditation tools to combat the stress of remote work.

Emerging Trends: AI, Automation, and the Future of Work

Looking ahead, artificial intelligence (AI) and automation are poised to reshape the digital workplace. AI-powered virtual assistants like Google Assistant and Alexa are streamlining workflows and boosting productivity. Similarly, robotic process automation (RPA) solutions are automating repetitive tasks, freeing up human workers for more strategic activities. Meanwhile, the rise of augmented reality (AR) and virtual reality (VR) offers exciting possibilities for remote collaboration, training, and even on-the-job learning.

Investment Insights: Where the Money Flows

Investors are taking notice of the digital workplace's explosive growth. Venture capital (VC) funding in the space reached a record USD 8.6 billion in 2022, and this trend is expected to continue. Investors are particularly interested in AI-powered solutions, automation tools, and platforms that enhance employee experience and well-being. Additionally, cybersecurity remains a key focus area, with companies developing innovative solutions to protect sensitive data in a distributed work environment.

Market Share Analysis: Beyond Revenue and Numbers

Understanding market share in the digital workplace goes beyond simply looking at revenue figures. Factors like adoption rate, user engagement, customer satisfaction, and Net Promoter Score (NPS) paint a more nuanced picture. Additionally, understanding regional variations in user preferences and tech ecosystems is crucial. The Asia Pacific region, for instance, is a hotbed of digital workplace innovation, with local players like Alibaba and Tencent making significant strides.

Latest Company Updates:

- Jan 6, 2024: This move strengthens Google's Workspace suite with project management capabilities, potentially challenging Monday.com and Atlassian.

- Jan 3, 2024: This acquisition expands Zoom beyond video conferencing into the cloud contact center market, competing with Twilio and Genesys.