Rise of Cloud-Based Solutions

The digital workplace market in Europe is experiencing a pronounced shift towards cloud-based solutions. Organizations are increasingly migrating their operations to the cloud to enhance flexibility, scalability, and cost-effectiveness. Recent data suggests that cloud adoption among European businesses has reached 80%, reflecting a growing preference for solutions that facilitate remote access and collaboration. This trend is further fueled by the need for real-time data sharing and communication among distributed teams. As companies embrace cloud technologies, the digital workplace market is poised for substantial growth, with projections indicating a 15% increase in market size over the next few years, driven by the advantages offered by cloud-based platforms.

Advancements in Cybersecurity Measures

In the context of the digital workplace market in Europe, the increasing emphasis on cybersecurity is a critical driver. With the rise of remote work, organizations face heightened risks of cyber threats, prompting them to prioritize robust security measures. Recent statistics indicate that cyberattacks on businesses in Europe have surged by 30% in the past year. Consequently, companies are investing significantly in advanced cybersecurity solutions to protect sensitive data and maintain operational integrity. This focus on security not only safeguards organizational assets but also fosters trust among employees and clients, thereby enhancing the overall appeal of digital workplace solutions.

Regulatory Compliance and Data Protection

The digital workplace market in Europe is significantly influenced by stringent regulatory compliance and data protection laws. The General Data Protection Regulation (GDPR) mandates that organizations implement comprehensive data management practices, which directly impacts their digital workplace strategies. Companies are compelled to adopt solutions that ensure compliance with these regulations, leading to increased investments in data protection technologies. As organizations navigate the complexities of compliance, the digital workplace market is expected to expand, with a projected growth rate of 10% annually. This trend underscores the importance of integrating compliance measures into digital workplace solutions to mitigate legal risks and enhance operational efficiency.

Growing Emphasis on Digital Skills Development

The digital workplace market in Europe is witnessing a growing emphasis on digital skills development among employees. As organizations transition to more technology-driven environments, the demand for skilled personnel capable of leveraging digital tools becomes paramount. Recent surveys indicate that over 60% of European companies identify skills gaps as a significant barrier to effective digital transformation. In response, businesses are increasingly investing in training programs and digital literacy initiatives to equip their workforce with the necessary competencies. This focus on skills development not only enhances employee performance but also drives the adoption of innovative digital workplace solutions, thereby contributing to market growth.

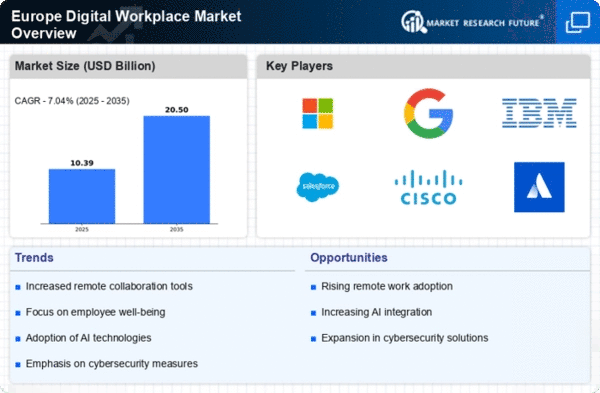

Increased Demand for Flexible Work Arrangements

The digital workplace market in Europe experiences a notable surge in demand for flexible work arrangements. Organizations are increasingly recognizing the necessity of accommodating diverse employee needs, which has led to a shift in workplace dynamics. According to recent data, approximately 70% of employees express a preference for hybrid work models, blending remote and in-office work. This trend compels companies to invest in digital workplace solutions that facilitate seamless collaboration and communication. As a result, the digital workplace market in Europe is projected to grow at a CAGR of 12% over the next five years, driven by the need for adaptable work environments that enhance productivity and employee satisfaction.