Increase in Telehealth Services

The rise of telehealth services is a significant driver in the Digital Payment in Healthcare Market. As more patients opt for virtual consultations, the need for efficient digital payment solutions has become paramount. Telehealth platforms require integrated payment systems that facilitate seamless transactions for remote services. Data suggests that telehealth visits have increased by over 30%, necessitating the development of payment solutions that cater specifically to this mode of healthcare delivery. This trend is likely to encourage healthcare providers to invest in digital payment technologies that support telehealth, ensuring that patients can easily pay for services rendered. The integration of payment solutions within telehealth platforms is expected to enhance the overall patient experience and streamline revenue cycles for healthcare organizations.

Growing Emphasis on Patient Experience

The Digital Payment in Healthcare Market is increasingly influenced by the growing emphasis on enhancing patient experience. Healthcare providers recognize that a seamless payment process is integral to overall patient satisfaction. Research indicates that 75% of patients are more likely to return to a healthcare facility that offers easy and efficient payment options. Consequently, healthcare organizations are investing in user-friendly digital payment platforms that simplify billing and payment processes. This focus on patient-centric solutions not only improves the financial experience for patients but also reduces administrative burdens for providers. As the industry evolves, the integration of digital payment systems is likely to become a standard practice, reflecting the importance of patient experience in healthcare delivery.

Rising Demand for Contactless Payments

The Digital Payment in Healthcare Market is experiencing a notable surge in demand for contactless payment solutions. Patients increasingly prefer the convenience and safety of contactless transactions, which allow for quick and hygienic payments. According to recent data, nearly 60% of patients express a preference for contactless options when settling medical bills. This trend is likely to drive healthcare providers to adopt digital payment systems that facilitate such transactions. As a result, the industry is witnessing a shift towards integrating advanced payment technologies, which not only enhance patient satisfaction but also streamline the billing process. The growing acceptance of mobile wallets and near-field communication (NFC) technology further supports this trend, indicating a robust future for contactless payments in the healthcare sector.

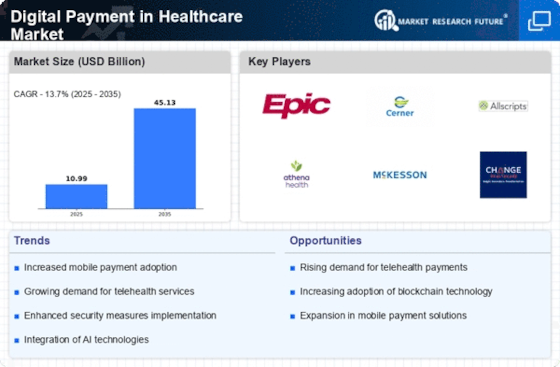

Technological Advancements in Payment Solutions

Technological advancements are significantly shaping the Digital Payment in Healthcare Market. Innovations such as blockchain technology, artificial intelligence, and machine learning are being integrated into payment systems to enhance security and efficiency. These technologies offer robust solutions for fraud prevention and data management, which are critical in the healthcare sector. For instance, blockchain can provide secure and transparent transaction records, while AI can streamline payment processing and reduce errors. As healthcare organizations increasingly adopt these advanced technologies, the digital payment landscape is expected to evolve rapidly. The potential for improved operational efficiency and reduced costs further underscores the importance of technological advancements in driving the adoption of digital payment solutions.

Government Initiatives Supporting Digital Payments

Government initiatives play a crucial role in shaping the Digital Payment in Healthcare Market. Various regulatory bodies are actively promoting the adoption of digital payment systems to enhance efficiency and transparency in healthcare transactions. For instance, policies aimed at reducing cash transactions and encouraging electronic payments are being implemented. In some regions, incentives are provided to healthcare providers who adopt digital payment solutions, thereby fostering a more conducive environment for innovation. This governmental support is expected to catalyze the growth of digital payment systems, as healthcare organizations align with regulatory expectations. The potential for increased funding and resources for technology adoption further underscores the importance of these initiatives in driving the digital payment landscape.