Market Share

Digital Payment Healthcare Market Share Analysis

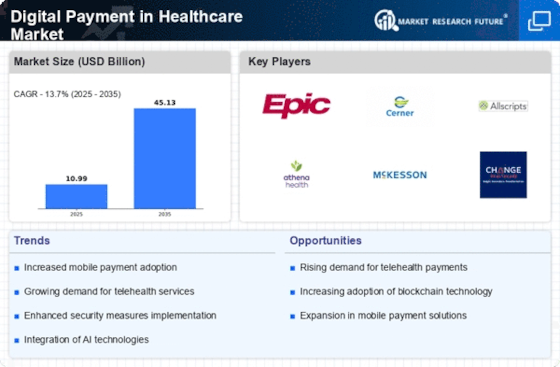

The digital payment industry has emerged as a key player in the quickly changing healthcare scene, revolutionizing the way financial transactions take place in the sector. The success and long-term viability of digital payment systems in the healthcare industry are significantly influenced by market share positioning tactics. The establishment of seamless interaction with current healthcare platforms is one of the company's primary strategies. This entails working together with medical billing software and electronic health record systems to guarantee a seamless and effective payment procedure for patients and healthcare providers. Gaining market share also depends on providing safe and legal payment options. To foster confidence between healthcare institutions and patients, digital payment providers need to abide by certain requirements. Putting in place strong encryption standards, two-factor authentication, and additional cybersecurity measures makes a business stand out from the competition and establishes it as a safe and dependable payment partner for the healthcare industry. Customizing digital payment systems to the requirements of healthcare transactions is another important tactic. This can entail adding automated claims processing, customizable invoicing choices, and support for several payment methods. Businesses can establish themselves as specialized and essential partners for medical facilities and get a substantial market share by comprehending the nuances of healthcare payments. Apart from collaborations, emphasizing the user experience can be a crucial approach to gain market share. The adoption rates of healthcare applications and services by consumers and healthcare professionals can be greatly impacted by the design of user-friendly interfaces and simple payment procedures. A smooth user experience strengthens an electronic payment solution's position in the market by promoting faster adoption and continuous usage. Moreover, digital payment solutions may be continuously improved and optimized by using a data-driven strategy to comprehend consumer behavior and preferences. A progressive method of developing new products makes businesses appear adaptable and progressive, which is important in a market where technology is driving change. Finally, one of the most important aspects of market share leadership is educating and raising awareness among patients and healthcare professionals about the advantages of digital payments. Traditional payment methods may be familiar to many healthcare industry stakeholders; a thorough education effort might close this knowledge gap. Showcasing the effectiveness, affordability, and reliability of digital payment systems can encourage uptake and acceptance, which will eventually result in a bigger market share.

Leave a Comment