Top Industry Leaders in the Digital Payment Healthcare Market

Competitive Landscape of Digital Payment in Healthcare Market

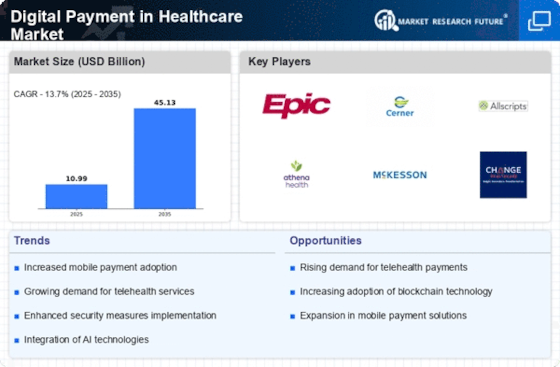

The healthcare industry is undergoing a digital transformation, and one of the key drivers is the surge in digital payments. Streamlining patient billing, improving administrative efficiency, and enhancing convenience are just some of the benefits fueling the rapid adoption of these solutions. This dynamic landscape presents a lucrative opportunity for established players and emerging startups alike, but navigating it requires a keen understanding of the competitive environment.

Key Players:

- Fiserv, Inc

- Aliant Payments

- First Data Corporation

- Wirecard AG

- Stripe

- Worldpay, LLC

- Payments Direct, Inc

- PayPal

- Aquanima S.A. (Spain)

Strategies Adopted:

- Partnerships and Integrations: Collaboration is key in the healthcare payments market. Players are forming alliances with EHR providers, healthcare institutions, and other FinTech companies to expand their reach and offer comprehensive solutions.

- Technology Innovation: Continuous investment in cutting-edge technologies like artificial intelligence, blockchain, and data analytics is driving innovation in the market. These technologies are used to personalize payment experiences, improve fraud detection, and streamline administrative tasks.

- Focus on Patient Experience: Prioritizing patient convenience and satisfaction is crucial for success. Players are offering intuitive online and mobile payment interfaces, flexible payment options, and transparent billing practices to enhance the patient experience.

- Regulatory Compliance: The healthcare industry is subject to strict regulations regarding data privacy and security. Players must ensure their solutions comply with HIPAA and other relevant regulations to maintain trust and avoid legal complications.

Factors for Market Share Analysis:

- Geographic Reach: The global healthcare payments market is fragmented, with regional variations in adoption rates and preferred payment methods. Understanding the specific needs of different regions is crucial for market share growth.

- Target Segments: The healthcare industry comprises various segments, each with distinct payment needs. Focusing on specific segments like hospitals, clinics, or patients can offer a competitive edge.

- Technology and Features: Offering advanced features like integrated billing, automated claim submission, and data security can attract healthcare providers and differentiate a player from the competition.

- Pricing and Value Proposition: Pricing models and the value proposition offered are crucial for market penetration. Players need to balance competitive pricing with features and services that add value for both providers and patients.

New and Emerging Companies:

- Healthcare-focused BNPL (Buy Now, Pay Later) companies: Companies like Paytient and ClearHealth are offering BNPL options for medical procedures, making healthcare more accessible and affordable for patients.

- Blockchain-based payment platforms: These platforms aim to improve transparency, security, and efficiency in healthcare payments by leveraging blockchain technology.

- Artificial intelligence-powered solutions: AI is used to personalize payment experiences, predict patient behavior, and automate billing tasks, offering significant efficiency gains for healthcare providers.

Current Company Investment Trends:

- Investment in R&D: Leading players are investing heavily in research and development to stay ahead of the curve. This includes exploring new technologies, developing innovative features, and improving security measures.

- Strategic Acquisitions and Partnerships: Acquisitions and partnerships are common strategies to expand market reach, acquire new technologies, and enter new market segments.

- Focus on Data Analytics: Companies are increasingly leveraging data analytics to understand customer behavior, personalize payment experiences, and optimize their offerings.

- Expansion into Global Markets: Established players are looking beyond their domestic markets to expand their reach and capitalize on the growing demand for digital healthcare payments globally.

Latest Company Updates:

Jan 18, 2024: Apple Pay has announced a partnership with Healthcare.gov, allowing users to easily pay their health insurance premiums directly through their iPhone or Apple Watch. This integration aims to improve convenience and boost online enrollment for the government's health insurance marketplace.

Jan 17, 2024: JPMorgan Chase has unveiled JP Morgan Health Pay, a comprehensive platform designed to streamline healthcare payments for providers and patients. The platform offers billing and claims management, patient financing options, and real-time payment processing.

Jan 15, 2024: The U.S. Department of Health and Human Services has proposed new regulations aimed at improving healthcare data interoperability and facilitating the exchange of electronic medical records. These regulations are expected to impact the development and adoption of digital payment solutions in healthcare.

Beta feature