Consumer Preference for Convenience

Consumer preferences are shifting towards convenience in healthcare transactions, significantly impacting the digital payment-healthcare market. Patients increasingly favor payment methods that offer ease of use, such as mobile wallets and online payment platforms. A recent survey indicates that over 60% of patients prefer digital payment options for their healthcare expenses. This trend is prompting healthcare providers to adopt user-friendly payment solutions that streamline the billing process. As a result, the digital payment-healthcare market is likely to witness substantial growth as providers enhance their payment systems to meet consumer expectations for convenience and efficiency.

Increased Focus on Patient Engagement

The digital payment-healthcare market is witnessing an increased focus on patient engagement strategies. Healthcare providers are recognizing the importance of involving patients in their financial decisions, which is leading to the development of more transparent payment processes. By offering clear information about costs and payment options, providers can enhance patient satisfaction and loyalty. In 2025, it is expected that patient engagement initiatives will contribute to a 20% increase in the adoption of digital payment solutions. This trend underscores the necessity for healthcare organizations to prioritize patient-centric approaches in their payment systems, ultimately driving growth in the digital payment-healthcare market.

Rising Demand for Telehealth Services

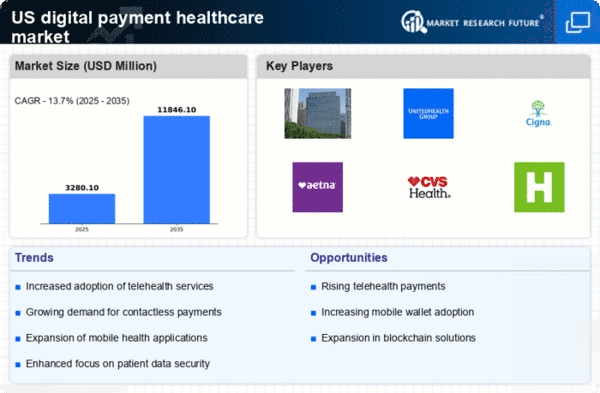

The digital payment-healthcare market is experiencing a notable surge in demand for telehealth services. As patients increasingly seek remote consultations, healthcare providers are adapting their payment systems to accommodate this shift. In 2025, it is estimated that telehealth services will account for approximately 25% of all healthcare visits in the US. This transition necessitates efficient digital payment solutions that can seamlessly integrate with telehealth platforms. Consequently, the digital payment-healthcare market is likely to expand as providers invest in technologies that facilitate secure and convenient transactions for virtual consultations. The convenience of digital payments enhances patient satisfaction, thereby driving further adoption of telehealth services.

Government Initiatives and Regulations

Government initiatives play a crucial role in shaping the digital payment-healthcare market. Recent regulations aimed at promoting interoperability and enhancing patient access to healthcare information are likely to drive the adoption of digital payment solutions. For instance, the Centers for Medicare & Medicaid Services (CMS) has introduced policies that encourage the use of electronic health records (EHRs) and digital payment systems. By 2025, it is projected that compliance with these regulations will lead to a 30% increase in the utilization of digital payment methods among healthcare providers. This regulatory environment fosters innovation and investment in the digital payment-healthcare market, ultimately benefiting both providers and patients.

Technological Advancements in Payment Systems

Technological advancements are driving innovation within the digital payment-healthcare market. The integration of artificial intelligence (AI) and machine learning (ML) into payment systems is enhancing transaction security and efficiency. These technologies enable real-time fraud detection and personalized payment experiences, which are becoming increasingly important in the healthcare sector. By 2025, it is anticipated that AI-driven payment solutions will account for a significant portion of transactions in the digital payment-healthcare market. This evolution not only improves security but also fosters trust among patients, encouraging them to utilize digital payment methods for their healthcare needs.