Rising Demand for Telehealth Services

The digital payment-healthcare market is experiencing a notable surge in demand for telehealth services in Germany. This trend is driven by the increasing acceptance of remote consultations, which allows patients to access healthcare from the comfort of their homes. As of 2025, approximately 30% of patients in Germany utilize telehealth services, necessitating efficient digital payment solutions to facilitate these transactions. The convenience of digital payments enhances patient satisfaction and encourages further adoption of telehealth, thereby propelling the growth of the digital payment-healthcare market. Moreover, healthcare providers are increasingly integrating telehealth into their service offerings, which further emphasizes the need for secure and efficient payment systems to manage billing and reimbursements effectively.

Increased Focus on Health Data Privacy

The emphasis on health data privacy is becoming increasingly critical. With the rise of digital transactions, concerns regarding data security and patient confidentiality have intensified. In Germany, regulatory frameworks such as the General Data Protection Regulation (GDPR) mandate strict compliance regarding the handling of personal health information. As a result, healthcare providers are investing in secure payment systems that ensure data protection while facilitating transactions. This focus on privacy not only builds trust among consumers but also drives the demand for sophisticated digital payment solutions. The commitment to safeguarding health data is likely to be a key differentiator in the competitive landscape of the digital payment-healthcare market.

Government Initiatives for Digital Health

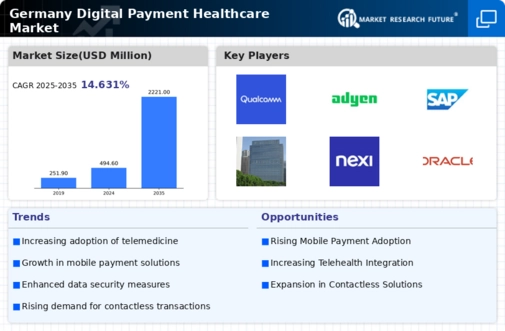

Government initiatives aimed at promoting digital health solutions are significantly impacting the digital payment-healthcare market in Germany. The German government has implemented various policies to encourage the adoption of digital health technologies, including financial incentives for healthcare providers who utilize electronic health records and telemedicine. As a result, the market is projected to grow at a CAGR of 15% over the next five years. These initiatives not only enhance the accessibility of healthcare services but also necessitate robust digital payment systems to streamline transactions. The alignment of government policies with market needs creates a conducive environment for the expansion of digital payment solutions within the healthcare sector.

Technological Advancements in Payment Systems

Technological advancements are playing a crucial role in shaping the digital payment-healthcare market. Innovations such as blockchain technology and artificial intelligence are being integrated into payment systems, enhancing security and efficiency. In Germany, the adoption of these technologies is expected to increase transaction speeds and reduce fraud, which is vital for maintaining trust in digital payment solutions. As of 2025, it is estimated that 40% of healthcare providers in Germany will implement advanced payment technologies. This shift not only improves the overall patient experience but also positions the digital payment-healthcare market for sustained growth as providers seek to leverage technology to meet evolving consumer expectations.

Growing Consumer Preference for Digital Transactions

There is a marked shift in consumer behavior towards digital transactions in the healthcare sector, which is influencing the digital payment-healthcare market. In Germany, a significant portion of the population, approximately 70%, prefers using digital payment methods for healthcare services. This preference is driven by the convenience, speed, and security associated with digital payments. As consumers increasingly seek seamless payment experiences, healthcare providers are compelled to adopt advanced digital payment solutions. This trend not only enhances patient engagement but also streamlines administrative processes, thereby fostering growth in the digital payment-healthcare market. The integration of user-friendly payment interfaces is likely to further enhance consumer satisfaction.