Digestive Health Products Market Summary

As per Market Research Future analysis, The Global Digestive Health Products Market was estimated at 55.235 USD Billion in 2024. The digestive health industry is projected to grow from 59.4 USD Billion in 2025 to 121.8 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Digestive Health Products Market is experiencing a dynamic shift towards innovative and personalized solutions.

- The market witnesses a notable rise in plant-based products, reflecting changing consumer preferences.

- Personalization in digestive health solutions is becoming increasingly prevalent, catering to individual needs.

- Technology integration in health monitoring is enhancing consumer engagement and product effectiveness.

- Key drivers such as increasing health awareness and the aging population are propelling growth, particularly in the probiotics and chewable segments.

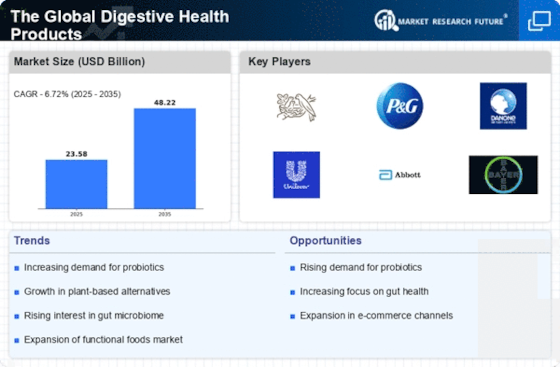

Market Size & Forecast

| 2024 Market Size | 55.235 (USD Billion) |

| 2035 Market Size | 48.22 (USD Billion) |

| CAGR (2025 - 2035) | 7.5% |

Major Players

Nestle (CH), Procter & Gamble (US), Danone (FR), Unilever (GB), Abbott Laboratories (US), Bayer AG (DE), Kraft Heinz (US), Reckitt Benckiser (GB), GSK (GB)