Market Share

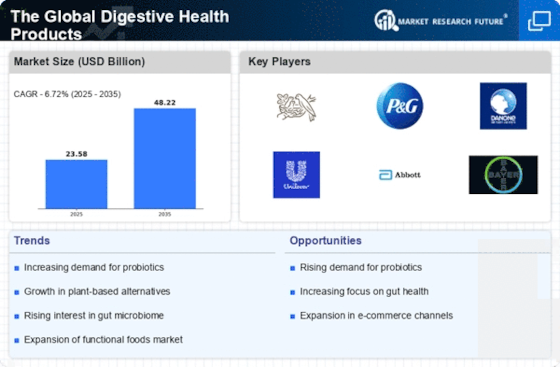

Digestive Health Products Market Share Analysis

In the competitive landscape of the digestive health products market, market share positioning strategies play a crucial role in determining the success of manufacturers. One prevalent strategy involves product differentiation, where companies aim to distinguish their offerings by incorporating unique ingredients, advanced formulations, or specific health benefits. Probiotic containing, digestive health supplemetns that are backed by scientific research or improve with prebiotic blends which is developed by the use of natural sugar could be also attractive for consumers who look for results to improve gastrointestinal wellness. On top of this, the goods are differentiated, which helps both build an image of a brand as well as provides a substantive edge in the market.

Consumer behavior is highly affected by the sales prices, and therefore, pricing strategies are a backbone of the digestive health products market. Others select competitive pricing which can raise the sales volume and obtain bigger market share. It is to make the goods affordable for all people. This strategy is super applicable for markets where consumers' low income and affordability is of major consideration to them. On the other hand, discount strategies aim at appealing to the segment ready to pay more for digestive health products that might be designed on a special formula, provide better performance, or promote better health. Finding the marketplace as well as its optimal pricing and value for money balance is extremely important for manufacturers to successfully position their products.

The development of beneficial bi-products of digestion is a significant driving force making digestive health products market run forward. Awareness building about the need to maintain a good digestive health is an emerging global trend. Consumers world over are gradually acknowledging the fact that digestion is one of the more important aspects of our overall well being and therefore keeping a healthy gut has become a vital component of their overall health. Such a consumption gain can be explained by the growing popularity of gut-related diseases, thus bringing next to the point of increasing demand and another driver for this market.

According to a study, the rate of illness due to gastrointestinal diseases caused to over 40% of the global population in 2020, which affects their life style significantly. Hitherto, the use of dietary supplements to promote gut health has significantly increased as people are more inclined to use the products as prevention measures for effective digestion. People dealing with other health conditions and people who are on the medication have a high risk of digestive health issues and to reduce such conditions, they tend to use digestive health products to provide some relief.

Apart from the factor of lifestyle, the healthcare environment is also an important component of the surging market, as a lot of hospitals now offer digestive supplements in their patient care. That was a fundamental point of these supplements and was caused by their facilitation of a quicker food digestion, which is quite important since it helps the digestive health improvement as such. A large part of this success is due to the fact that it directly impacts the consumers as providers of this type of health product as well as it is a cornerstone to the growth of the digestive health market.

Continual innovation is one of the key factors and it is required for holding and even increasing existing niche in digestive health products industry. Manufacturers invest in research and development to introduce new formulations, delivery formats, or combinations that address emerging consumer needs. Innovations such as probiotic-infused foods, personalized nutrition solutions, or products targeting specific digestive concerns keep brands at the forefront of consumer preferences and contribute to market share growth.

Leave a Comment