Market Trends

Key Emerging Trends in the Digestive Health Products Market

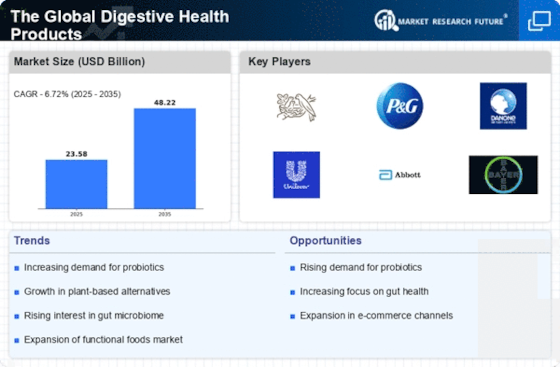

The digestive health products market is witnessing notable trends that reflect the evolving preferences and priorities of consumers in the pursuit of overall well-being. One prominent trend is the increasing demand for probiotics, fueled by a growing awareness of the importance of a balanced gut microbiome. Hybrid cultures, which consists of the good bacteria, are one of the reasons why people try to consume them, and it is because they have the potential to support the gut system and also strengthen the body’s immune system. With the increasing awareness among consumers of the connection between the health of their intestinal microbiome and their overall wellbeing, the demand for products containing probiotics with specific bacterial strains continues to rise.

Among the other noteworthy trends in the digestive health products market is the raise in the which activate probiotics. Prebiotics are non-digestible fiber compounds and they must be consumed to feed the favorable bacteria in the gut, thus enabling their multiplication and increase in activity. The latest studies link this phenomenon with a broader notion that providing the right nutrients to the existing good gut bacteria isn't as simple as using probiotics; it means to ensure that the body has the necessary components for these organisms to thrive. Consequently, foods that deliver prebiotics, in conjunction with probiotic or apart as separate supplants, are rising higher on the priority lists of the pertinent health-minded consumers.

Not just dietary supplements but also those that focus on particular digestion centered bother are having a noticeable increase in demand. Consumers ask for the products that help with some digestive problems which often include the bloating, gas, and irregular bowel movements. Dextrin supplements, which help split the nutrients and the digestion process, are one of the things which now are in trend. This trend represents the direction that personalized resolutions for digestive health are being taken considering that people are looking for exactly products matching their particular needs and concerns.

The clean-label movement in digestive health products segment of the market is significant now more than ever as people today are turning their back on complex additives and are leaning more toward products whose ingredient list is short and clear with immediate understanding. Natural products, free of artificial additives, preservatives or needlessly adding fillers to them are now your favourite option when it comes to healthy eating. The manufacturers who take this opportunity to develop digestive health products utilizing natural ingredients and also the same recognizable ingredient stand to capture the largest market share because of their ability to fulfill both the effectiveness and ingredient fairness aspects that the consumers give importance to.

Just as the alignment of digestive health with broader health maintenance is already a rippling trend. Consumers connect their gut health with overall well-being because they learn that. Finally various comprehensive strategy is the only solution. This is clearly the consumption of the functional foods and beverages with the strong probiotic. Consumer patterns commonly include purchase of products like yoghurt, kefir and other lactic cultures welling up organic probiotics. They comprise daily diet so as to capture digestive health.

Digital shopping has become a watershed moment for trending of the market transforming consumers into individuals who access and Buy functional food & beverage. Online media platforms give thousands of opportunities, where clients are able to make researches, compare reviews, and make fair buying decisions on couch or in office. The rise of e-commerce also facilitates direct-to-consumer marketing strategies, enabling manufacturers to engage with consumers and build brand loyalty through digital platforms.

Leave a Comment