Aging Population

The demographic shift towards an aging population in the US is likely to impact the digestive health-drinks market positively. As individuals age, they often experience digestive issues, leading to an increased demand for products that can alleviate these concerns. Research suggests that older adults are more inclined to invest in health products that support their digestive health, including functional beverages. This demographic trend indicates a potential market expansion, as the aging population seeks convenient and effective solutions for maintaining digestive wellness. Furthermore, the digestive health-drinks market may see a rise in targeted marketing strategies aimed at older consumers, thereby enhancing product visibility and accessibility.

Rise of Online Retailing

The expansion of online retail channels is transforming the way consumers access products in the digestive health-drinks market. E-commerce platforms provide convenience and a wider selection of products, allowing consumers to explore various brands and formulations from the comfort of their homes. Data shows that online sales of health-related beverages have surged, with a notable increase in direct-to-consumer models. This shift not only enhances consumer access but also allows brands to engage directly with their audience, fostering brand loyalty. As more consumers turn to online shopping for their health needs, the digestive health-drinks market is likely to benefit from this trend, leading to increased sales and market penetration.

Focus on Preventive Health

The growing emphasis on preventive health measures is influencing consumer choices in the digestive health-drinks market. As individuals seek to maintain their health proactively, they are increasingly turning to beverages that offer digestive benefits. This trend is supported by a wealth of information available on the internet, which educates consumers about the importance of gut health in overall well-being. Market data indicates that products marketed for digestive health are experiencing higher sales growth compared to traditional beverages. This focus on prevention rather than treatment suggests a shift in consumer mindset, which is likely to sustain the growth of the digestive health-drinks market in the coming years.

Growing Health Consciousness

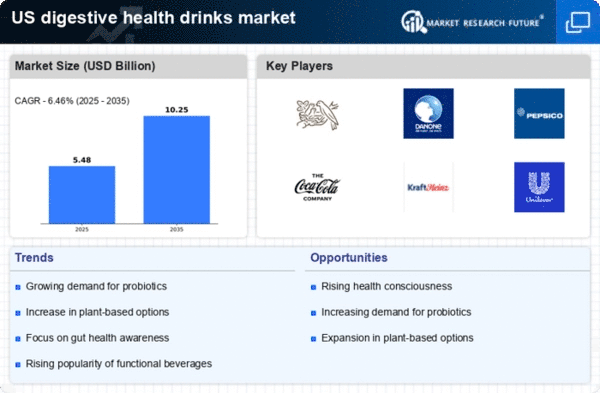

The increasing awareness of health and wellness among consumers appears to be a primary driver for the digestive health-drinks market. As individuals become more informed about the benefits of gut health, they are actively seeking products that promote digestive wellness. This trend is reflected in market data, indicating that the digestive health-drinks market is projected to grow at a CAGR of approximately 8% over the next five years. Consumers are gravitating towards beverages that contain probiotics, prebiotics, and other functional ingredients that support digestive health. This shift in consumer behavior suggests a robust demand for products that not only taste good but also contribute positively to overall health, thereby propelling the growth of the digestive health-drinks market.

Innovative Product Development

Innovation in product formulation and packaging is driving the digestive health-drinks market forward. Manufacturers are increasingly investing in research and development to create unique beverages that cater to diverse consumer preferences. This includes the introduction of plant-based options, functional drinks with added vitamins, and low-sugar alternatives. Market analysis indicates that innovative products are likely to capture a larger share of the market, as consumers are drawn to novel offerings that promise enhanced health benefits. The emphasis on clean labels and transparency in ingredient sourcing further supports this trend, as consumers demand more information about what they consume. Consequently, the focus on innovation is expected to significantly influence the growth trajectory of the digestive health-drinks market.