Botanical Extracts Market Summary

As per Market Research Future analysis, the Botanical Extracts Market Size was estimated at 6.592 USD Billion in 2024. The Botanical Extracts industry is projected to grow from 7.218 USD Billion in 2025 to 17.89 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Botanical Extracts Market is experiencing robust growth driven by consumer preferences for natural ingredients and innovative extraction techniques.

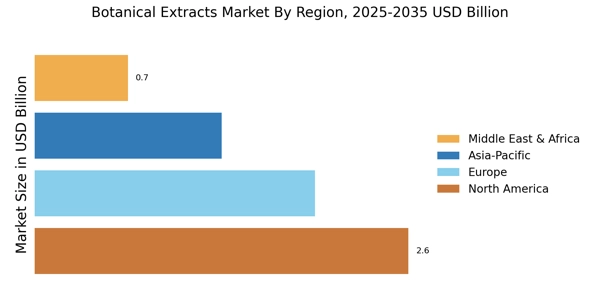

- The demand for natural ingredients continues to rise, particularly in North America, which remains the largest market for botanical extracts.

- Innovations in extraction techniques are enhancing the quality and efficiency of botanical extracts, appealing to diverse applications.

- The liquid segment dominates the market, while the powder segment is witnessing the fastest growth, reflecting changing consumer preferences.

- Key market drivers include the growing consumer preference for organic products and the expansion of the nutraceutical sector, particularly in the Asia-Pacific region.

Market Size & Forecast

| 2024 Market Size | 6.592 (USD Billion) |

| 2035 Market Size | 17.89 (USD Billion) |

| CAGR (2025 - 2035) | 9.5% |

Major Players

Givaudan (CH), Symrise (DE), BASF (DE), Kalsec (US), Naturex (FR), Sundew (IN), Herbalife (US), Indena (IT), Frutarom (IL), Aromatech (FR)