Growing Health Consciousness

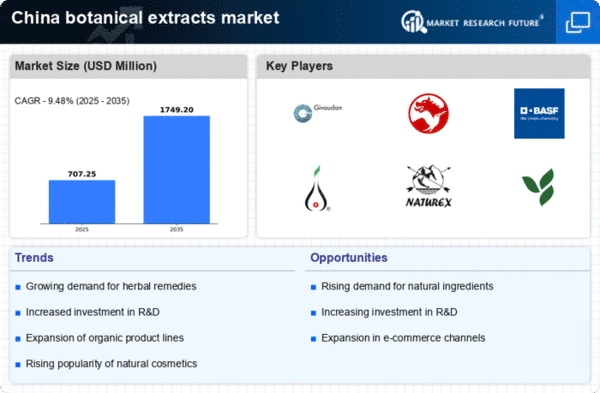

The increasing awareness of health and wellness among consumers in China appears to be a primary driver for the botanical extracts market. As individuals become more health-conscious, they tend to seek natural and organic products, which has led to a surge in demand for botanical extracts. This trend is reflected in the market data, indicating that the market is projected to grow at a CAGR of approximately 8% from 2025 to 2030. Consumers are increasingly turning to herbal remedies and supplements, which are perceived as safer alternatives to synthetic products. This shift in consumer behavior is likely to bolster the botanical extracts market, as manufacturers respond by expanding their product lines to include a wider variety of natural extracts. The growing health consciousness among the population is thus a significant factor influencing the botanical extracts market.

Expansion of the Food and Beverage Sector

The rapid expansion of the food and beverage sector in China is contributing to the growth of the botanical extracts market. With the increasing incorporation of natural flavors and colors in food products, manufacturers are increasingly sourcing botanical extracts to meet consumer preferences for clean-label products. The market data suggests that the food and beverage segment accounts for nearly 40% of the total demand for botanical extracts. This trend is driven by a shift towards healthier eating habits, where consumers are more inclined to choose products that contain natural ingredients. As the food and beverage industry continues to innovate and diversify, the demand for botanical extracts is expected to rise, further propelling the growth of the botanical extracts market.

Rising Popularity of Traditional Medicine

The resurgence of interest in traditional medicine practices in China is significantly impacting the botanical extracts market. Traditional Chinese Medicine (TCM) has long utilized various botanical extracts for therapeutic purposes, and this cultural heritage is experiencing a revival among consumers seeking holistic health solutions. Market data indicates that the TCM segment is projected to grow by approximately 10% annually, reflecting a strong preference for natural remedies. This trend is likely to encourage the integration of botanical extracts into modern healthcare products, thereby expanding the market. The botanical extracts market is thus poised to benefit from this cultural shift, as more consumers embrace the principles of TCM and seek out products that align with these values.

Increased Investment in Research and Development

The botanical extracts market in China is witnessing a surge in investment in research and development (R&D) activities. Companies are increasingly focusing on developing innovative products that leverage the health benefits of botanical extracts. This trend is supported by government initiatives aimed at promoting herbal medicine and natural products, which may lead to enhanced funding opportunities for R&D. Market data indicates that R&D expenditure in the herbal product sector has increased by approximately 20% over the past few years. This investment is likely to result in the introduction of new and improved botanical extracts, catering to the evolving preferences of consumers. Consequently, the botanical extracts market stands to gain from these advancements, as companies strive to meet the growing demand for effective and natural health solutions.

Technological Advancements in Extraction Methods

Technological advancements in extraction methods are playing a crucial role in enhancing the efficiency and quality of botanical extracts. Innovations such as supercritical fluid extraction and ultrasonic extraction are becoming increasingly prevalent in the industry, allowing for higher yields and better preservation of bioactive compounds. This is particularly relevant in China, where the demand for high-quality botanical extracts is on the rise. Market data suggests that the adoption of these advanced extraction techniques could lead to a reduction in production costs by up to 15%, making it more feasible for manufacturers to offer competitive pricing. As a result, the botanical extracts market is likely to experience growth driven by improved product quality and cost-effectiveness, attracting more players to the market.