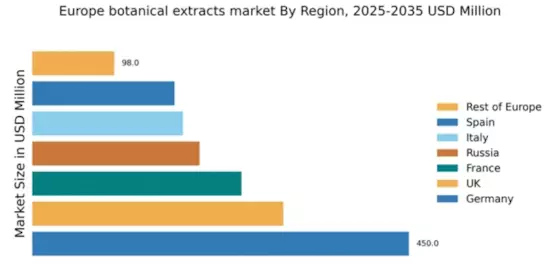

Germany : Strong Demand and Innovation Drive Growth

Key markets include major cities like Berlin, Munich, and Frankfurt, where demand for botanical extracts is particularly high. The competitive landscape features significant players such as Symrise and BASF, which leverage innovation to meet consumer needs. Local dynamics are characterized by a strong emphasis on quality and sustainability, with applications spanning food, beverages, and personal care products. The business environment is favorable, supported by government initiatives promoting green technologies.

UK : Health Consciousness Fuels Market Growth

Key markets include London, Manchester, and Birmingham, where the demand for botanical extracts is on the rise. The competitive landscape features players like Givaudan and Kalsec, who are innovating to cater to health-focused consumers. Local market dynamics emphasize the importance of quality and traceability, with applications in food, beverages, and dietary supplements. The business environment is dynamic, with increasing investments in R&D for natural ingredients.

France : Botanical Extracts in Culinary Arts

Key markets include Paris, Lyon, and Marseille, where culinary innovation drives demand for botanical extracts. Major players like Naturex and Givaudan are well-established, focusing on premium quality and unique flavor profiles. The competitive landscape is vibrant, with local producers emphasizing artisanal methods. The business environment is conducive to innovation, particularly in the food and beverage sector, where botanical extracts are increasingly used for flavoring and health benefits.

Russia : Market Potential in Diverse Sectors

Key markets include Moscow and St. Petersburg, where demand for botanical extracts is expanding. The competitive landscape features both local and international players, with companies like BASF and Herbalife making significant inroads. Local dynamics are characterized by a growing consumer base seeking natural alternatives. The business environment is evolving, with increasing investments in sectors such as personal care and food, where botanical extracts are gaining traction.

Italy : Culinary and Cosmetic Uses Thrive

Key markets include Milan, Rome, and Florence, where culinary and cosmetic industries are thriving. Major players like Symrise and Naturex are prominent, focusing on high-quality extracts for gourmet food and luxury cosmetics. The competitive landscape is characterized by a blend of traditional and modern approaches, with local artisans gaining recognition. The business environment is favorable, with increasing consumer demand for authenticity and quality in products.

Spain : Botanical Extracts in Food and Health

Key markets include Barcelona and Madrid, where the demand for botanical extracts is increasing in food and beverage sectors. The competitive landscape features players like Kalsec and Frutarom, who are focusing on innovation and quality. Local dynamics emphasize the importance of sustainability and traceability, with applications in health supplements and culinary products. The business environment is dynamic, with growing investments in R&D for natural ingredients.

Rest of Europe : Emerging Trends Across Various Regions

Key markets include regions in Scandinavia and Eastern Europe, where demand for botanical extracts is growing. The competitive landscape features a mix of local and international players, with opportunities for new entrants. Local dynamics are characterized by a focus on sustainability and organic sourcing. The business environment is becoming more favorable, with increasing consumer interest in health and wellness products that utilize botanical extracts.