Regulatory Compliance

Regulatory compliance remains a critical driver in the Augmented Analytics In BFSI Market. Financial institutions are under constant pressure to adhere to stringent regulations and reporting requirements. Augmented analytics tools facilitate compliance by automating data collection and analysis, thereby reducing the risk of human error. According to recent studies, nearly 60% of financial organizations report that compliance-related costs have increased, prompting them to seek innovative solutions. By integrating augmented analytics, institutions can streamline their compliance processes, ensuring timely and accurate reporting. This not only mitigates risks associated with non-compliance but also enhances the overall governance framework within the organization. As regulatory landscapes evolve, the demand for augmented analytics solutions in the BFSI sector is likely to intensify.

Enhanced Fraud Detection

The rise in sophisticated fraud schemes has propelled the demand for enhanced fraud detection mechanisms within the Augmented Analytics In BFSI Market. Financial institutions are increasingly adopting augmented analytics to identify and mitigate fraudulent activities in real-time. By analyzing transaction patterns and customer behaviors, these tools can flag anomalies that may indicate fraud. Recent data suggests that financial institutions utilizing advanced analytics have seen a 30% reduction in fraud-related losses. This capability not only protects the institution's assets but also fosters customer trust. As fraudsters continue to evolve their tactics, the need for robust fraud detection solutions will likely drive further investment in augmented analytics technologies within the BFSI sector.

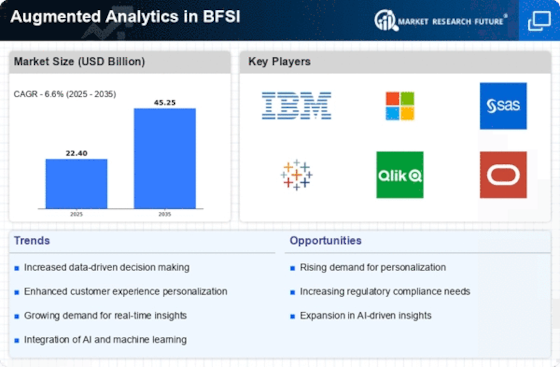

Data-Driven Decision Making

The Augmented Analytics In BFSI Market is increasingly driven by the need for data-driven decision making. Financial institutions are recognizing the importance of leveraging data analytics to enhance their strategic decisions. By utilizing augmented analytics, organizations can analyze vast amounts of data in real-time, leading to more informed decisions. This trend is underscored by the fact that approximately 70% of financial institutions are investing in advanced analytics capabilities. The ability to derive actionable insights from data not only improves operational efficiency but also enhances customer satisfaction, as institutions can tailor their offerings based on customer preferences and behaviors. As the demand for data-driven insights continues to grow, the Augmented Analytics In BFSI Market is poised for significant expansion.

Customer Experience Optimization

In the competitive landscape of the BFSI sector, customer experience optimization is a paramount driver for the Augmented Analytics In BFSI Market. Financial institutions are leveraging augmented analytics to gain deeper insights into customer preferences and behaviors. By analyzing customer interactions across various channels, organizations can tailor their services to meet individual needs. This approach has been shown to enhance customer satisfaction and loyalty, with studies indicating that institutions employing advanced analytics report a 25% increase in customer retention rates. As customer expectations continue to evolve, the ability to deliver personalized experiences will be crucial for success. Consequently, the demand for augmented analytics solutions that facilitate customer experience optimization is expected to grow.

Cost Reduction and Efficiency Gains

Cost reduction and efficiency gains are pivotal drivers in the Augmented Analytics In BFSI Market. Financial institutions are under constant pressure to optimize their operations while minimizing costs. Augmented analytics provides the tools necessary to streamline processes, automate routine tasks, and enhance productivity. By utilizing these advanced analytics solutions, organizations can identify inefficiencies and implement data-driven strategies to improve performance. Recent analyses indicate that institutions adopting augmented analytics have achieved up to a 20% reduction in operational costs. This not only contributes to the bottom line but also allows for reinvestment in innovation and customer service initiatives. As the need for cost-effective solutions intensifies, the Augmented Analytics In BFSI Market is likely to experience robust growth.